You don’t need a reminder that your client list’s future hinges on your ability to manage risk. But what may feel newer is the sharp edge that ICT risk management has taken on, particularly if you work with financial institutions operating in the EU.

Information and Communication Technology (ICT) risk management isn’t an emerging practice. But with the introduction of the Digital Operational Resilience Act (DORA), it now comes with regulatory weight. As of January 2025, DORA requires that financial entities across the EU maintain a rigorous and uniform approach to ICT risk. If you’re a third-party vendor contracting with one of those institutions, your compliance isn’t optional — it’s part of the decision-making criteria.

Let’s get into what that means for you — what the rules are, how you can meet them, and how to use DORA-aligned risk management to position your company as the most ready, reliable, and resilient choice.

Understanding ICT risk management

You already know the basics of ICT risk management: it’s the strategic use of systems, policies, and controls to reduce exposure to digital threats. Financial institutions have long invested in these measures.

What’s changing is the consistency of expectations. Where individual EU states once set their own standards, DORA levels the playing field with a binding framework.

The core of DORA and its ICT mandates

The heart of DORA is ICT risk. From general risk oversight to how third-party vendors are assessed and monitored, every component ties back to digital systems and the security, resilience, and governance around them.

The full framework includes:

- Risk management and control

- Oversight of third-party vendors

- Incident detection and response

- Operational resilience testing

- Threat and incident information exchange

What DORA means for third-party vendors

Third-party providers, in particular, are now subject to a level of scrutiny usually reserved for internal teams. To win and retain contracts, you’ll need to prove your approach to risk is compatible with the institutions you support. That means demonstrating adherence to a long list of expectations:

- Documented incident response strategies

- Proven resilience through testing

- Comprehensive information security practices

- Real-time monitoring systems

- Clear rationale behind your own vendor relationships (if any)

The goal? Not just to manage risk, but to contain it within what the institution deems acceptable. According to Article 6 of DORA, financial institutions must ensure all ICT-related activities and systems operate within their defined risk tolerance — and your services are part of that equation.

DORA Requirements Guide

Framework guidance from the EBA

The European Banking Authority (EBA) offers guidance on how to bring this to life. Their framework lays out what should be in place, from security policies and governance processes to audit trails and classification systems for incidents. If you’re managing or selling a solution that touches ICT, you’re expected to align with these pillars:

- Information security: policies, reviews, training

- Operations management: documented processes, compliance checks

- Monitoring: incident logs, recovery timelines

- ICT governance: risk oversight across your technology stack

- System acquisition: secure development and regular testing

Building DORA compliance into your sales strategy

So how do you show your work? You surface it — clearly and early, especially in the RFP process. Don’t wait for the prospect to connect the dots.

Map your documentation directly to DORA requirements.

It’s not enough to say you’re compliant — you need to show exactly how. Connecting your internal controls, incident response protocols, and resilience strategies to individual DORA mandates helps reviewers instantly understand how your product or service fits into their compliance framework. The more directly you link your capabilities to their needs, the less work they have to do to justify your selection.

Speak to how your policies satisfy each mandate.

A list of features isn’t persuasive. What matters is whether those features meet specific regulatory expectations. For example, if your product includes end-to-end encryption, explain how that supports DORA's requirement for information security. If your services include regular testing and monitoring, show how that aligns with resilience mandates. This approach helps prospects see you as a partner versus as a risk.

Highlight resilience and share testing results.

DORA places heavy emphasis on resilience. Financial institutions are expected to test and prove that all third-party solutions can withstand operational disruptions. If you can demonstrate that your systems have been tested — internally or through external audits — you reduce uncertainty. You also preempt follow-up questions, delays, and review cycles.

Provide documentation early and clearly.

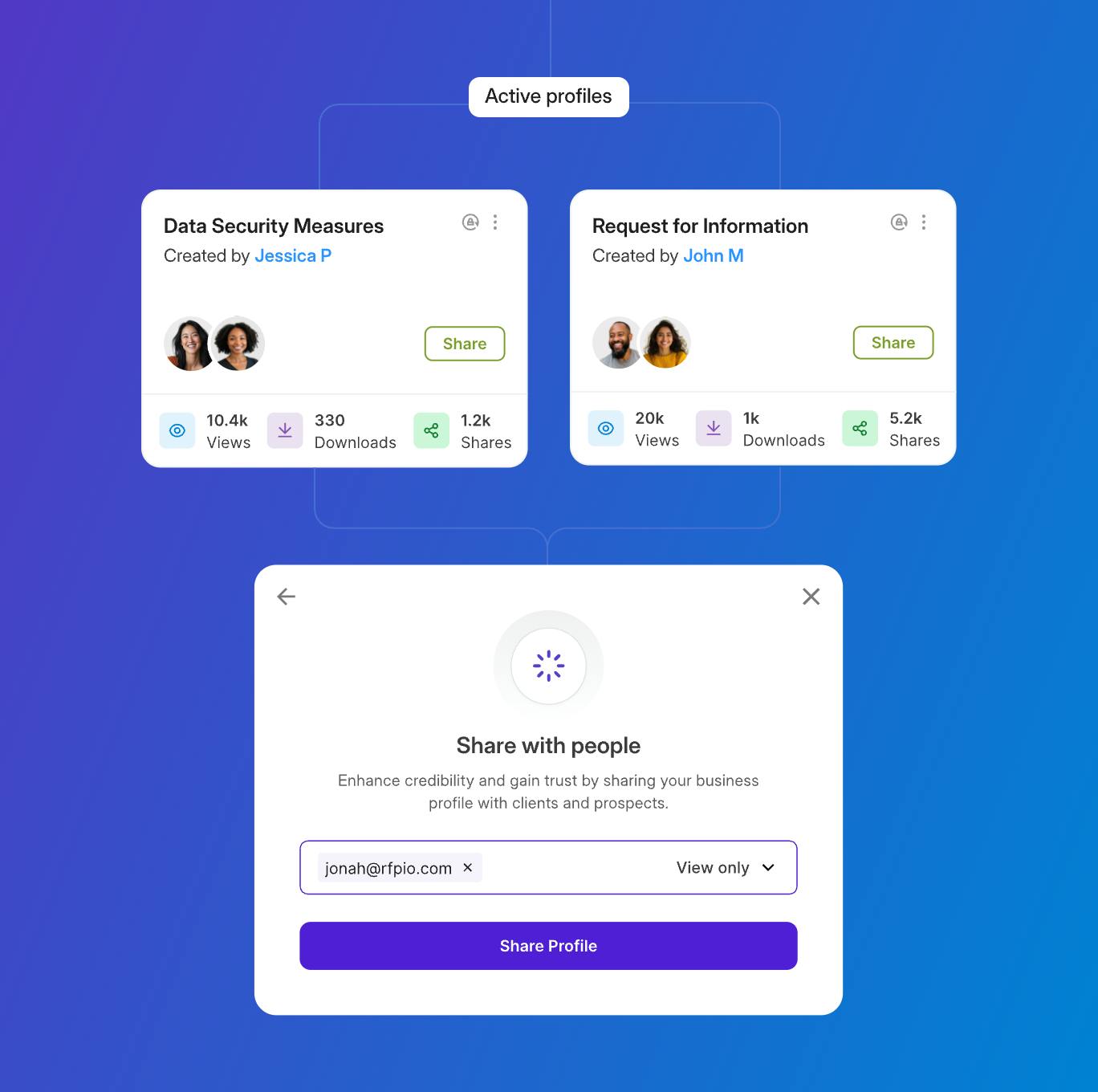

DORA compliance is documentation-heavy. Institutions need evidence of policies, procedures, and oversight mechanisms, not just marketing language. When you provide this documentation as part of your proposal package, you send a clear signal: your team understands the stakes, and you’ve done the work. Having a Trust Center — as is available in Profile Center — makes it easy for sales teams to proactively and confidently share current and complete DORA compliance information.

Customize your messaging.

While DORA provides a consistent regulatory baseline, each prospect will implement it differently depending on their size, structure, and internal policies. That’s why a generic answer won’t land. Tailoring your proposal to speak directly to your prospect’s business model and data environment helps them see how you reduce risk for them — not just in theory, but in practice.

In short, your sales materials aren’t just selling your product. They’re vouching for your compliance maturity. The more evidence you bring to the table, the easier it is for your buyer to move forward with confidence.

Centralizing your DORA documentation

Then, make that documentation easy to find and easy to update.

Centralization isn’t just about organization. It’s also about accuracy, agility, and long-term efficiency. DORA compliance requires detailed documentation of ICT-related protocols, security measures, and incident management strategies. If that data is spread across teams and systems, errors multiply and productivity drops. Centralizing it in a single source of truth ensures consistency and speeds up every future RFP or security review.

Responsive’s LookUp feature is designed to eliminate those inefficiencies. By giving teams self-service access to the most up-to-date, approved answers, LookUp lets you surface DORA-aligned content instantly, whether you’re responding to an RFI, a due diligence questionnaire, or an internal audit request. It works across functions, so information owners in legal, compliance, security, and IT can keep content accurate while sales and proposal teams can move quickly without second-guessing the source.

Microsoft took this approach and scaled it massively. With more than 18,000 users across global teams, they built a centralized Proposal Resource Library on the Responsive platform. That library now powers AI-assisted search, content recommendations, and automated workflows, saving Microsoft more than $17 million in time and labor costs. Their field teams don’t just find answers faster, they trust them to be current and on-brand across every compliance questionnaire, bid, or customer call.

Genpact saw similar results. With more than 115,000 employees and complex proposal workflows, they used Responsive to centralize and standardize their content operations. As a result, proposal quality improved across the board — and teams were able to spend less time hunting for approved responses and more time customizing answers to client needs.

The takeaway here? Clean, centralized, and well-maintained documentation isn’t just a DORA requirement — it’s a business advantage. It ensures you’re never scrambling to locate compliance artifacts under deadline pressure, it removes the risk of outdated content, and it gives every team the confidence to respond with clarity and speed.

How Responsive helps

Responsive can help. Customers use our platform to centralize compliance information, simplify collaboration across teams, and create reusable records of the protocols that matter most. Companies like Data Axle and Accruent use Responsive to surface the right answers and shorten turnaround times by up to 50%.

Additionally, Profile Center includes a free DORA compliance questionnaire to help customers demonstrate their compliance with DORA.

Your prospects are looking for clarity. Your documentation can offer it and your proposal can prove it.