Across the UK and European B2B landscape, responding to tenders, RFPs, and complex buyer questionnaires has become central to how businesses compete for revenue. The recently released 2025 State of Strategic Response Management Report: UK & European Market Trends Report reveals the latest data shaping how proposal teams work, collaborate, and evolve.

For bid and proposal professionals – and for revenue leaders – the report highlights a tougher B2B market characterized by tighter buyer control and a renewed focus on internal alignment.

Continue reading for five key takeaways that give you a preview of what’s covered in the full report.

Download the full report

1. Buyer expectations are rising across the board

Buyers are demanding more, faster, while operating with greater self-reliance. Nearly every aspect of the B2B buying process in Europe has intensified.

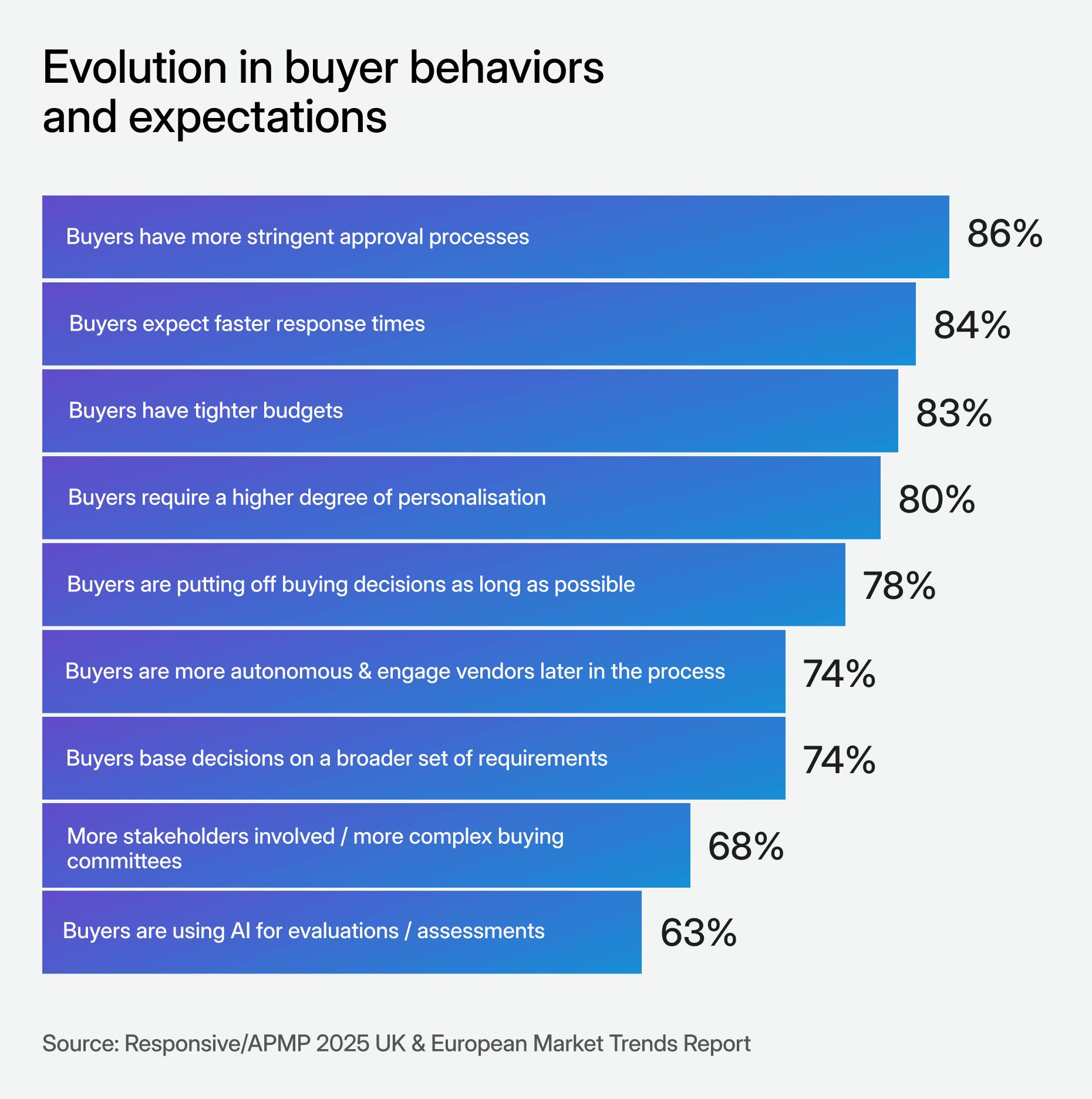

According to the report data:

- 86% of organisations say they face more stringent approval processes

- 84% cite increased pressure to deliver responses faster

- 83% note tighter spending from prospects

These changes are part of a larger transformation in how buying decisions are made. Buyers are delaying decisions (78%) and requiring greater personalisation (80%), signaling a market where even strong solutions need to be clearly, quickly, and credibly communicated.

More complex buying committees and expanded evaluation criteria are becoming the norm, not the exception. For bid and proposal professionals – and field-facing teams – this means the margin for error is shrinking. Every response must reflect accuracy, alignment, and a deep understanding of the buyer’s context.

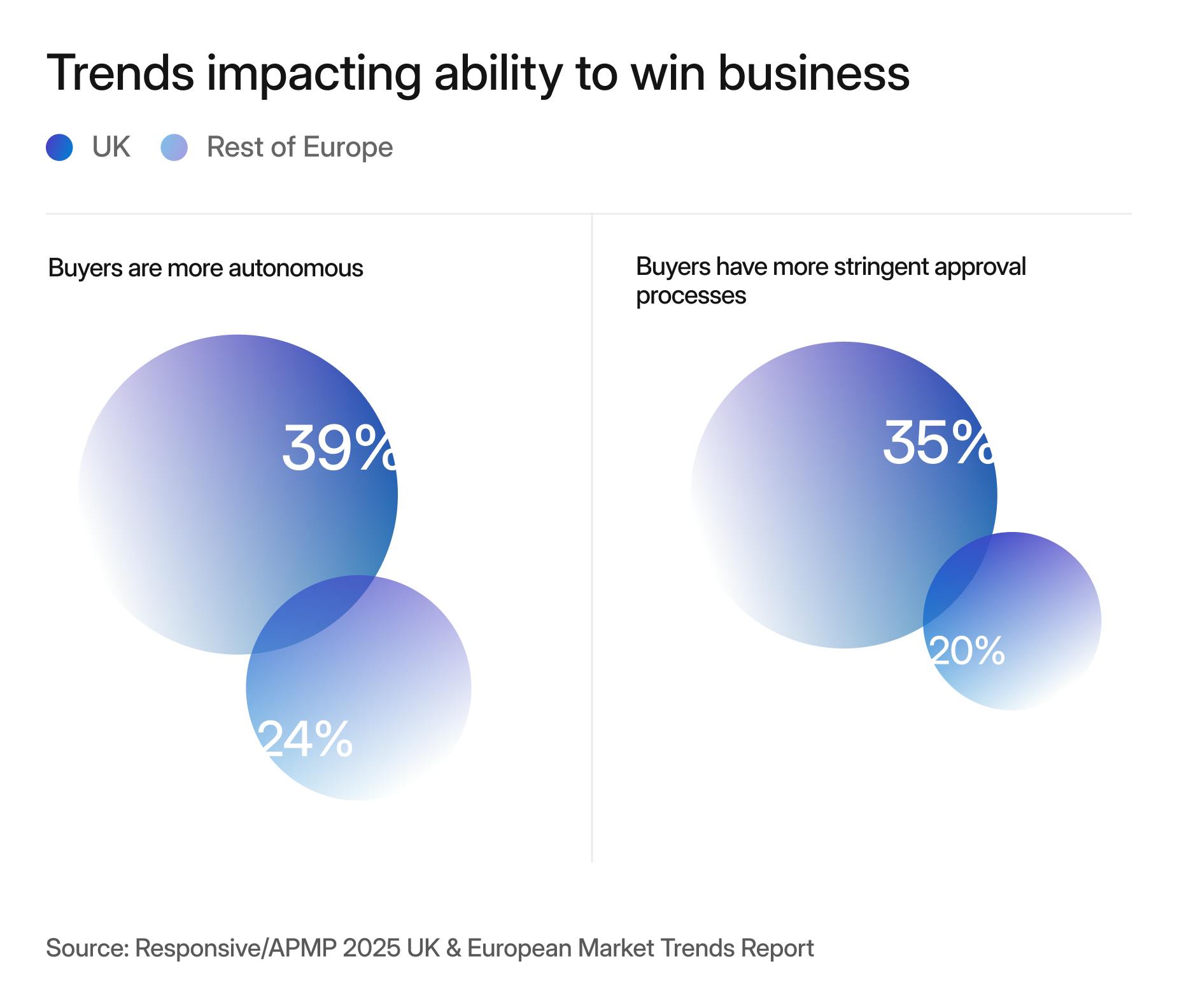

2. UK teams are navigating more complex internal reviews

UK organisations are feeling the weight of more stringent buyer approval processes. According to the report, 35% of UK businesses say these protocols are directly hindering their ability to close deals — nearly double the rate seen across the rest of Europe, where only 20% report the same challenge.

This added complexity stems from heightened financial oversight and an expanded roster of stakeholders involved in decision-making. It’s not uncommon for a single RFP to be evaluated by procurement, IT, legal, and senior leadership — each with distinct criteria and timeframes. And if AI is involved in the solution, there are often additional hurdles to overcome, like AI steering committees.

Success increasingly depends on managing these internal dynamics with proactivity and care, anticipating review needs and collaborating efficiently across departments.

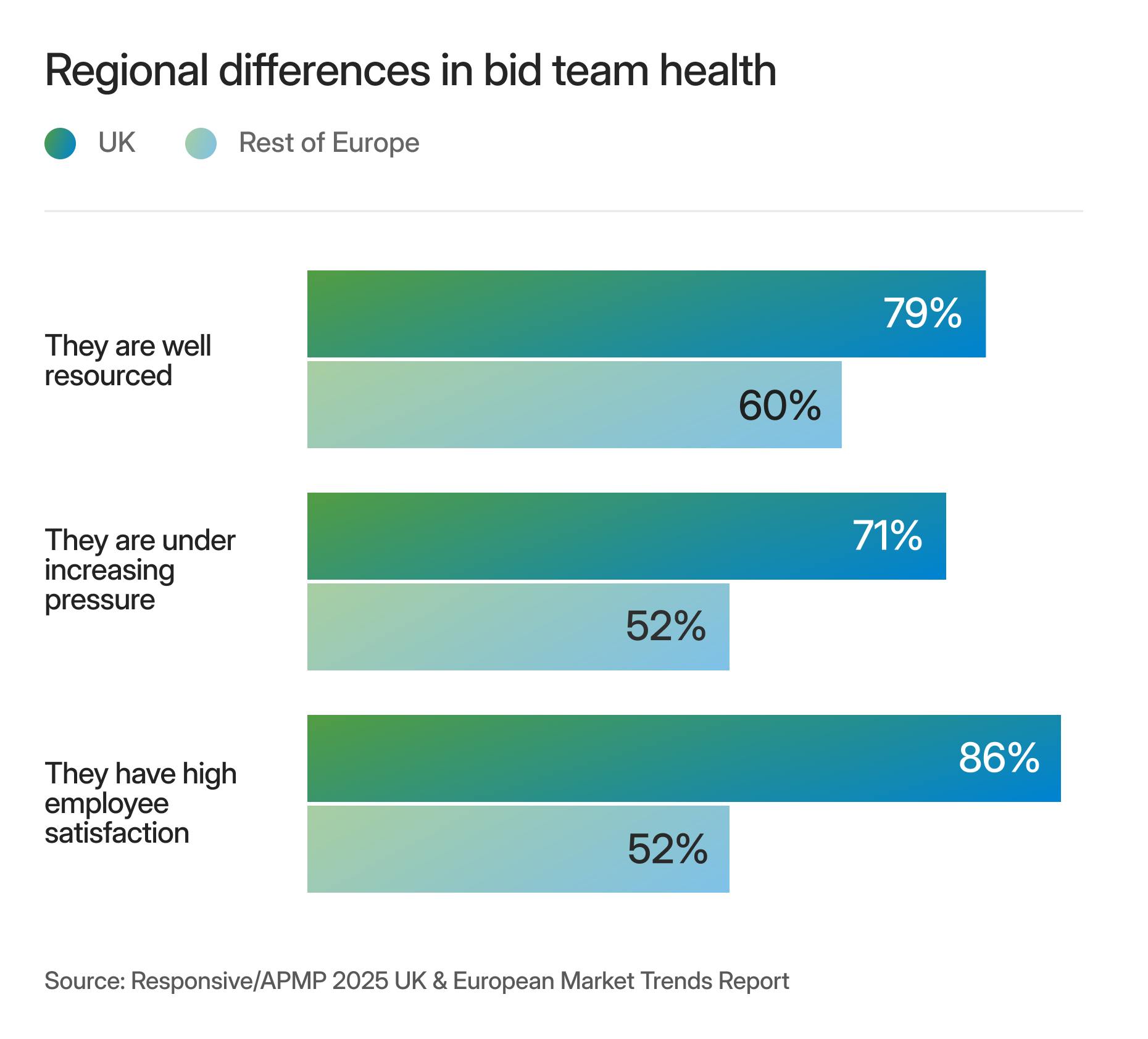

3. Bid teams are gaining visibility, but not without pressure

The bid and proposal function is increasingly being recognised as central to revenue:

- 86% of organisations say bid teams are significant contributors to business success.

- 79% view bid and proposal teams as strategic business partners

There is clear momentum behind the strategic elevation of bid teams. In the UK, this is reflected in both the resources being allocated and the expectations being set.

Interestingly, employee satisfaction among bid professionals in the UK is also higher than in the rest of Europe (86% vs. 52%), suggesting that greater investment is paying off — while simultaneously raising the bar. The challenge will be maintaining that morale as volume increases and expectations continue to grow.

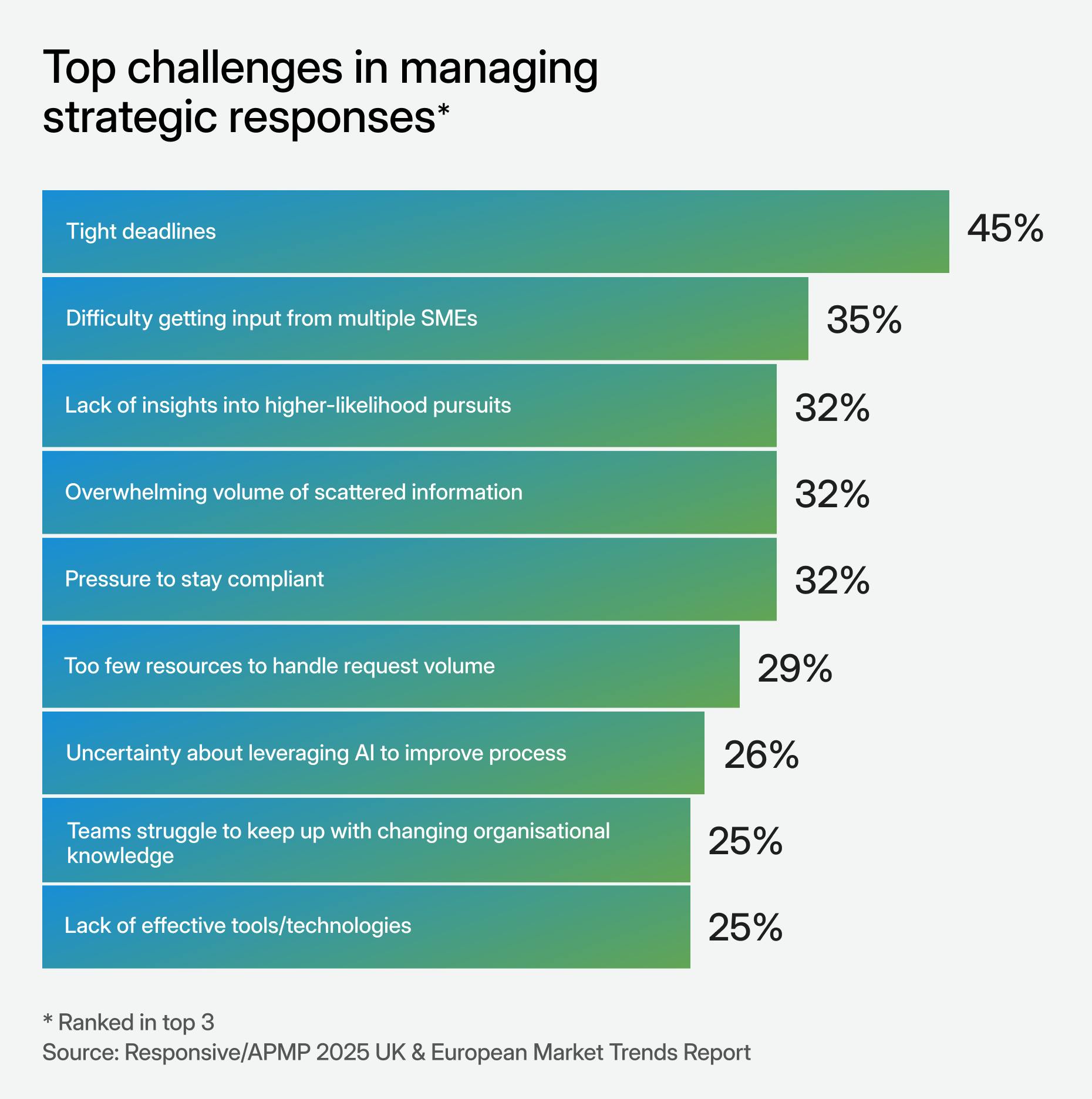

4. Strategic response remains burdened by complexity and urgency

Despite growing recognition of bid teams as revenue-critical, many still face a daily grind that limits their strategic potential.

According to the report, the most common challenges bid teams face are:

- Tight deadlines (45%)

- Difficulty getting input from multiple subject matter experts (SMEs) (35%)

- Lack of insights into higher-likelihood pursuits (32%)

- Overwhelming volume of scattered information (32%)

- Pressure to stay compliant (32%)

Each of these challenges paints a picture of process bottlenecks and fragmented collaboration. Many teams still spend hours chasing internal input or working without clear guidance on what’s worth pursuing. The result? Slower turnarounds, duplicated work, and proposals that don’t fully reflect the value a solution can deliver.

Compounding this issue is the sheer volume of information most teams have to manage. Scattered content, shifting organisational knowledge, and the pressure to stay compliant all add layers of friction. In total, more than one in four respondents (26%) noted uncertainty about how to best leverage AI to improve these processes, suggesting an opportunity that’s yet to be fully realised.

To move from reactive to strategic, teams need more than good intentions. They need access to the right knowledge, support from the right people, and systems that make all of that coordination possible (before the clock runs out).

5. AI adoption is cautious but gaining steam

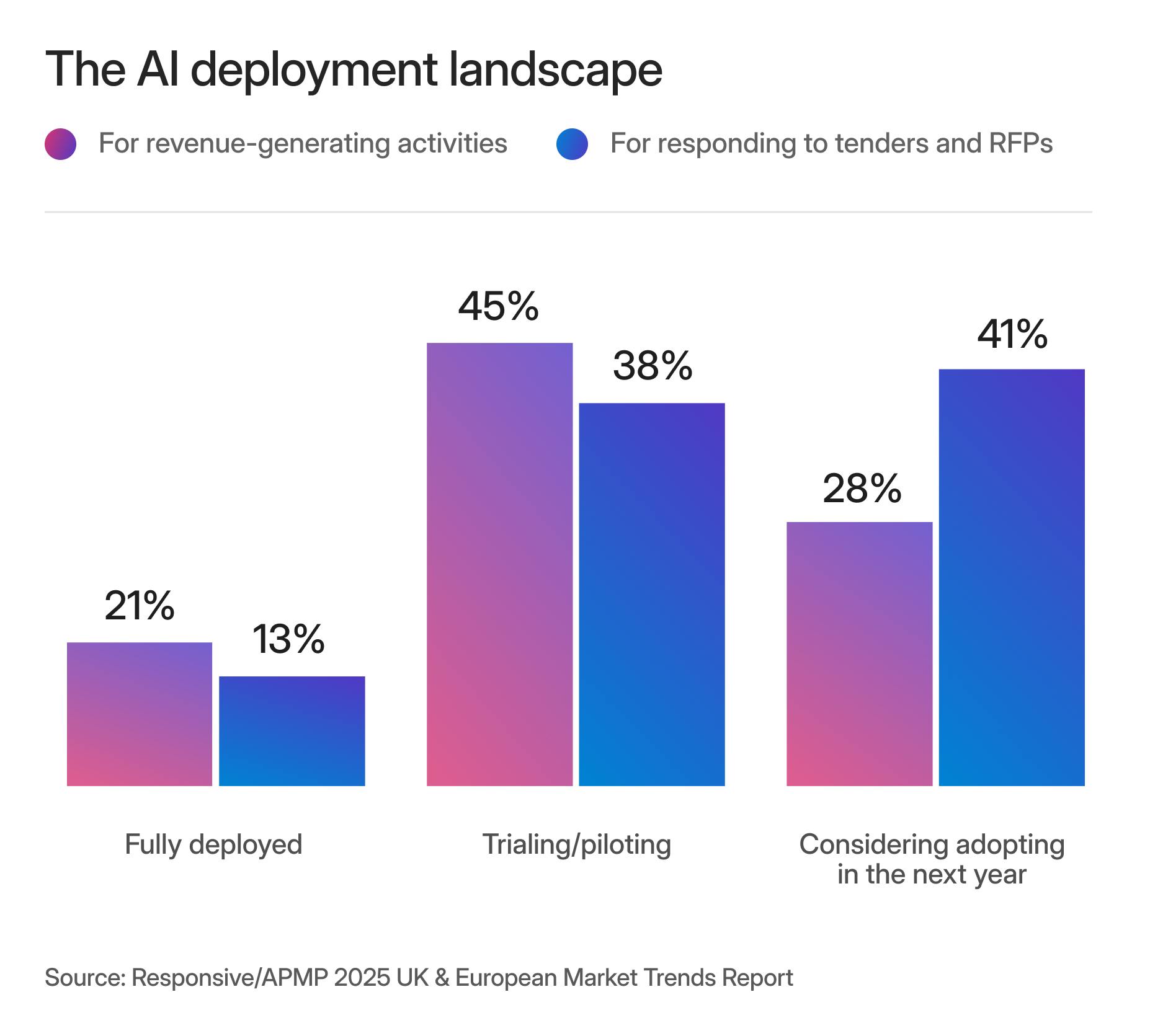

While AI is poised to play a transformative role in bid management, adoption across the UK and Europe remains measured. Only 21% of organisations have fully deployed AI in revenue activities, and just 13% say the same for responding to tenders and RFPs.

The data show that most teams are still in pilot mode — testing tools and identifying use cases before scaling broadly. This approach reflects a region-wide emphasis on purposeful implementation rather than reactive deployment. AI is being approached not as a quick fix, but as a long-term enabler of collaboration, consistency, and speed.

Used well, AI and AI agents can streamline manual tasks, surface historical insights, and help tailor responses. But to deliver those outcomes, organisations must focus on training, governance, and the quality of content feeding these tools. Leaders in this space aren’t simply automating — they’re rethinking how their teams work and where AI can best enhance the human judgement at the heart of every winning proposal.

These figures hint at broader shifts in how SRM is evolving across Europe, but the full report goes deeper. It unpacks where investments are flowing, how AI is being approached with care, and what top-performing teams are doing differently.