IFRS compliance software helps organizations meet international financial reporting standards while improving efficiency and accuracy. This vital software automates complex calculations, centralizes data management, and simplifies reporting processes, addressing key challenges of manual compliance approaches.

Key benefits include cost savings, enhanced accuracy, operational efficiency, and better decision-making. Let's explore how companies can go about selecting the right software solution, take a look at some implementation best practices, and some of the future trends in compliance technology.

Understanding IFRS compliance requirements

The International Financial Reporting Standards (IFRS) are a set of accounting standards developed by the International Accounting Standards Board (IASB) to create consistency and transparency in financial reporting globally.

These standards continue to evolve, with updates like IFRS 16 for lease accounting introducing significant changes to how organizations report their financial positions.

For many organizations, maintaining compliance with these standards is not just a regulatory requirement but also essential for providing accurate financial information to stakeholders. Non-compliance can result in financial penalties, reputational damage, and decreased investor confidence.

For example, a mid-sized manufacturing company expanding internationally might suddenly find itself needing to comply with IFRS for the first time, facing the challenge of translating years of financial data into a new reporting framework.

The challenges of manual IFRS compliance

Without specialized software, organizations often rely on manual processes for IFRS compliance, which can lead to several issues:

- Increased risk of human error in calculations and reporting

- Inefficient data management across multiple spreadsheets and systems

- Difficulty tracking changes and maintaining audit trails

- Time-consuming reporting processes, especially at period close

- Challenges in adapting to new standards and requirements

- Limited visibility into financial data across the organization

These challenges have driven many organizations to seek software solutions specifically designed to address IFRS compliance requirements.

Consider a finance team spending weeks manually gathering lease information from different departments, recalculating lease obligations in spreadsheets, and struggling to create consistent reports. All of this is done while worrying about formula errors that could lead to misstatements.

Key features of IFRS compliance software

Modern IFRS compliance software offers a range of features designed to streamline the compliance process:

Comprehensive lease data management

For standards like IFRS 16, software solutions provide:

- Centralized lease contract management

- Automatic classification of leases

- Calculation of right-of-use assets and lease liabilities

- Remeasurement capabilities for lease modifications

- Support for different currencies and payment structures

Automated accounting and calculations

- Generation of accounting schedules and journal entries

- Automated calculation of present values, interest, and depreciation

- Support for complex calculations required by standards like IFRS 9, IFRS 15, and IFRS 16

- Integration with general ledger systems

Robust reporting capabilities

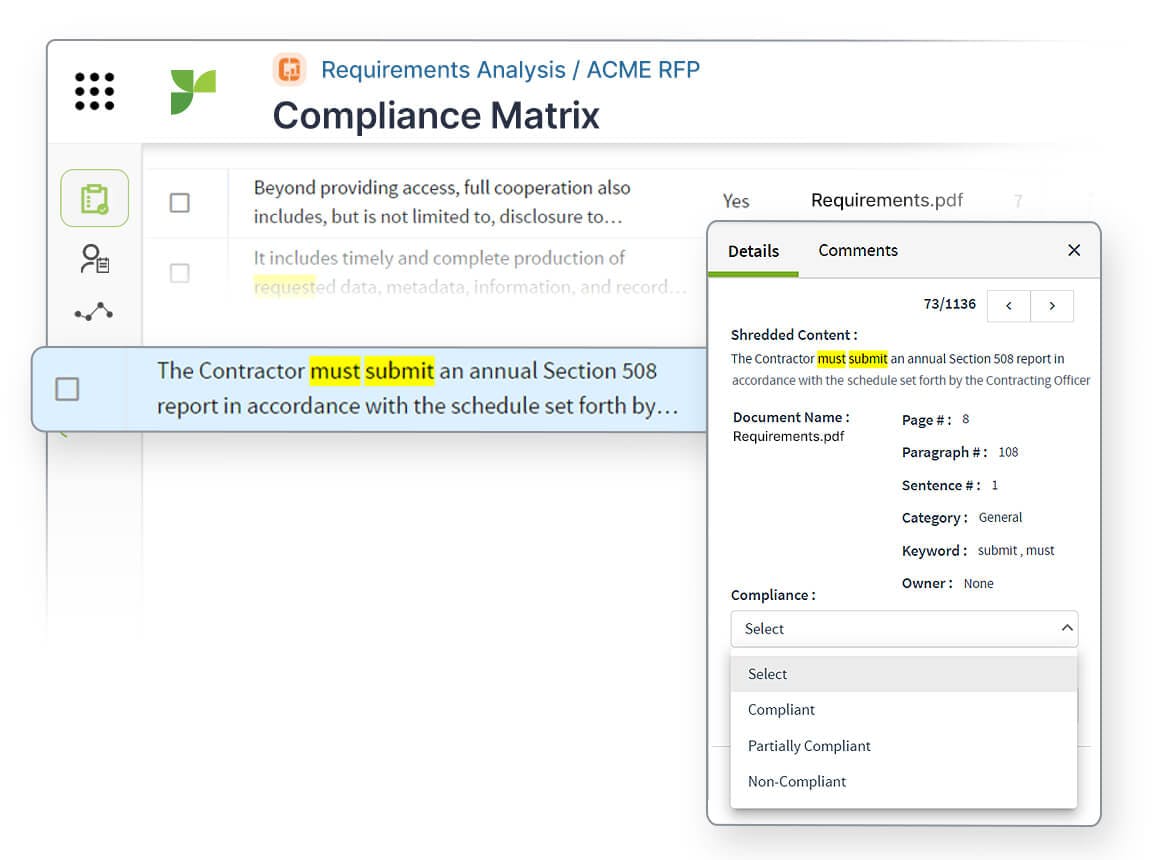

- Pre-configured disclosure reports aligned with IFRS requirements

- Customizable reporting templates

- Drill-down functionality for detailed analysis

- Visualization tools for better data interpretation

- Support for both internal management reporting and external regulatory reporting

Security and audit controls

- Role-based access controls to protect sensitive financial data

- Comprehensive audit trails tracking all changes

- Data validation to ensure accuracy and completeness

- Support for segregation of duties

- Compliance with cybersecurity standards

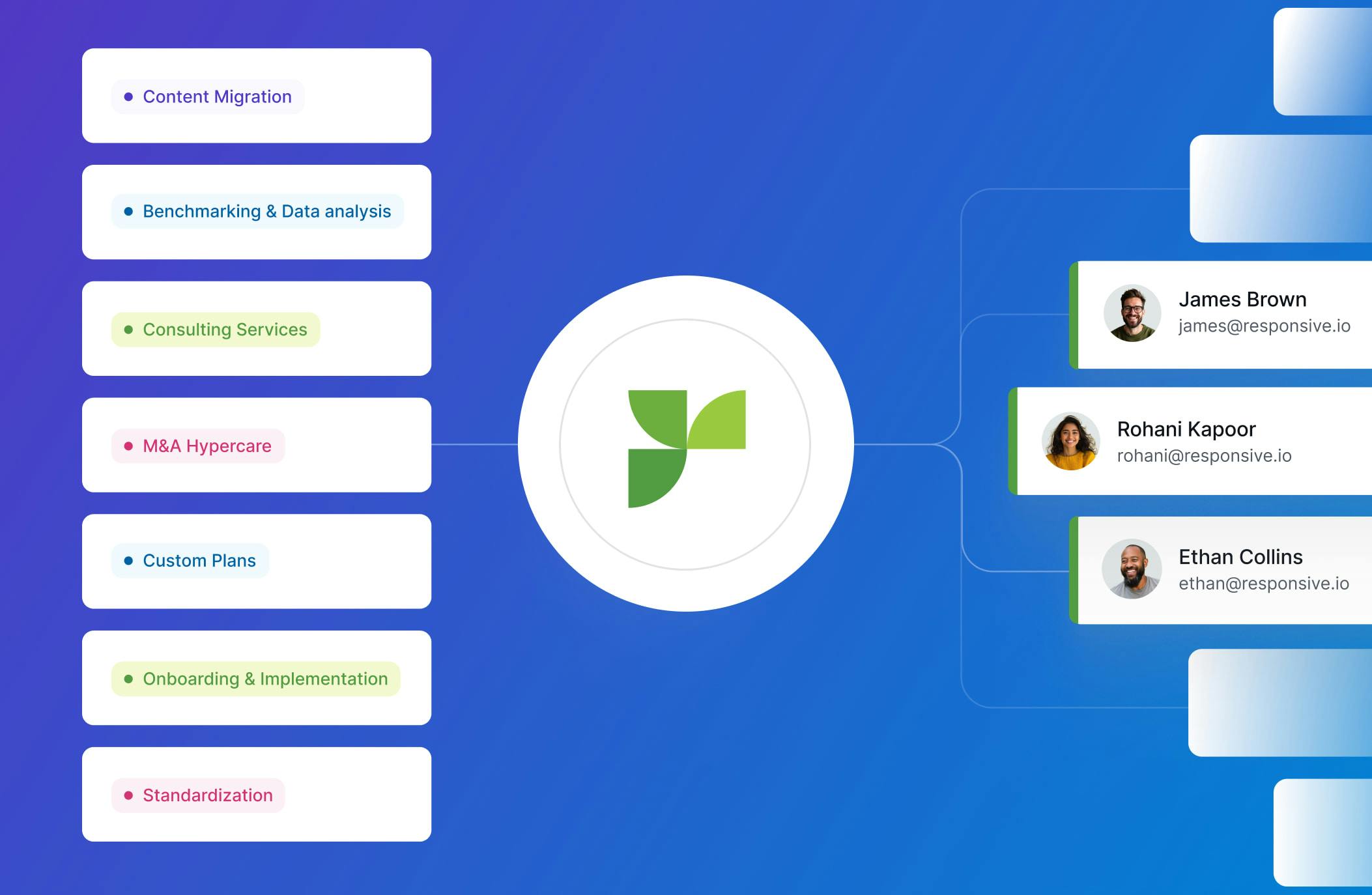

Integration capabilities

- API connections to existing financial systems

- Import/export functionality for data exchange

- Integration with ERP systems and general ledgers

- Compatibility with data analysis and business intelligence tools

Benefits of implementing IFRS compliance software

Cost savings and cost avoidance

IFRS compliance software delivers both immediate cost savings and longer-term cost avoidance:

Cost Savings:

- Reduced manual labor through automation of complex calculations

- Decreased need for specialized consultants for routine compliance tasks

- Minimized risk of errors that could lead to financial restatements

- Improved efficiency in the financial close process

Cost Avoidance:

- Prevention of potential regulatory penalties for non-compliance

- Avoidance of costs associated with audit issues

- Reduction in long-term costs of adapting to new standards manually

- Mitigation of risks related to data integrity and security breaches

For instance, a financial services company might reduce its month-end closing process from two weeks to three days after implementing IFRS compliance software, freeing up team members for more strategic work.

Enhanced compliance and accuracy

- Consistent application of IFRS standards across the organization

- Reduced risk of material misstatements in financial reporting

- Improved data quality through validation and controls

- Real-time visibility into compliance status

Operational efficiency

- Streamlined workflows for lease management and accounting

- Automated processes for regular accounting tasks

- Simplified monthly and quarterly close processes

- Reduced time spent on preparing financial statements and disclosures

Better decision-making

- Improved visibility into the financial impacts of leases and contracts

- Enhanced analytical capabilities through centralized data

- More timely financial information for management

- Better forecasting and planning capabilities

A retail company with hundreds of store leases could use compliance software to quickly model how potential lease renewals would impact financial statements, helping executives make better-informed expansion decisions.

Selecting the right IFRS compliance software

When evaluating IFRS compliance software solutions, organizations should consider:

Functional requirements

- Coverage of specific IFRS standards relevant to your business

- Ability to handle the volume and complexity of your financial data

- Support for multiple entities, currencies, and languages

- Customization capabilities to adapt to your specific reporting needs

Technical considerations

- Cloud-based versus on-premises deployment options

- Integration capabilities with existing financial systems

- Security features and data protection measures

- Scalability to accommodate business growth

- Performance for handling large data volumes

Vendor evaluation

- Vendor expertise in IFRS and accounting standards

- Implementation support and professional services

- Ongoing maintenance and updates for new standards

- Training and user support options

- Customer references and case studies

Implementation approach

- Project timeline and resource requirements

- Data migration strategy

- User adoption plan

- Testing and validation procedures

- Go-live support

Implementation best practices

Successful implementation of IFRS compliance software typically involves:

- Thorough needs assessment - Identify specific compliance requirements and pain points

- Stakeholder involvement - Engage accounting, finance, IT, and business units

- Data preparation - Clean and organize existing lease and contract data

- Phased approach - Consider implementing by standard or business unit

- Comprehensive testing - Validate calculations and reports against manual processes

- User training - Ensure users understand both the software and the underlying standards

- Post-implementation review - Assess effectiveness and identify areas for improvement

For example, a telecommunications company might begin its implementation by focusing only on equipment leases before expanding to property leases, allowing the team to become comfortable with the system before tackling more complex areas.

The future of IFRS compliance software

As financial reporting continues to evolve, IFRS compliance software is also advancing:

- AI and machine learning capabilities for pattern recognition and anomaly detection

- Advanced analytics for deeper insights into financial data

- Automated disclosure generation using natural language processing

- Predictive modeling for forecasting the impact of standard changes

- Mobile access for on-the-go compliance monitoring

IFRS compliance software improves financial management

IFRS compliance software provides organizations with a powerful tool to navigate the complexities of financial reporting standards. By automating calculations, centralizing data, and streamlining reporting processes, these solutions help organizations achieve and maintain compliance while reducing costs and improving operational efficiency.

For organizations evaluating IFRS compliance software options, it's essential to consider not just current requirements but also future needs as standards continue to evolve. The right solution should provide both immediate benefits in terms of compliance and efficiency, as well as long-term value through adaptability and ongoing support.

By making a strategic investment in IFRS compliance software, organizations can transform what was once a challenging compliance burden into an opportunity for improved financial management and decision-making.