The RFP is where decisions happen.

Buyers may research and compare vendors on their own, but once the RFP begins, everything that matters is on the page. In our 2025 study, Inside the Buyer’s Mind: What Shapes B2B Decisions Today, 8 in 10 buyers said the RFP has the biggest impact on their final decisions. It ranked higher than demos, proof of concept, or independent research.

Based on a survey of 350 B2B buyers across regions and industries, the findings show when RFPs appear, how preferences form, and what sets one response apart from another. The study also highlights how AI is changing what buyers expect from vendors and how they read the responses they receive.

The full report is now available for download. Keep reading here to get the highlights on what buyers really look for in an RFP.

Download the full report

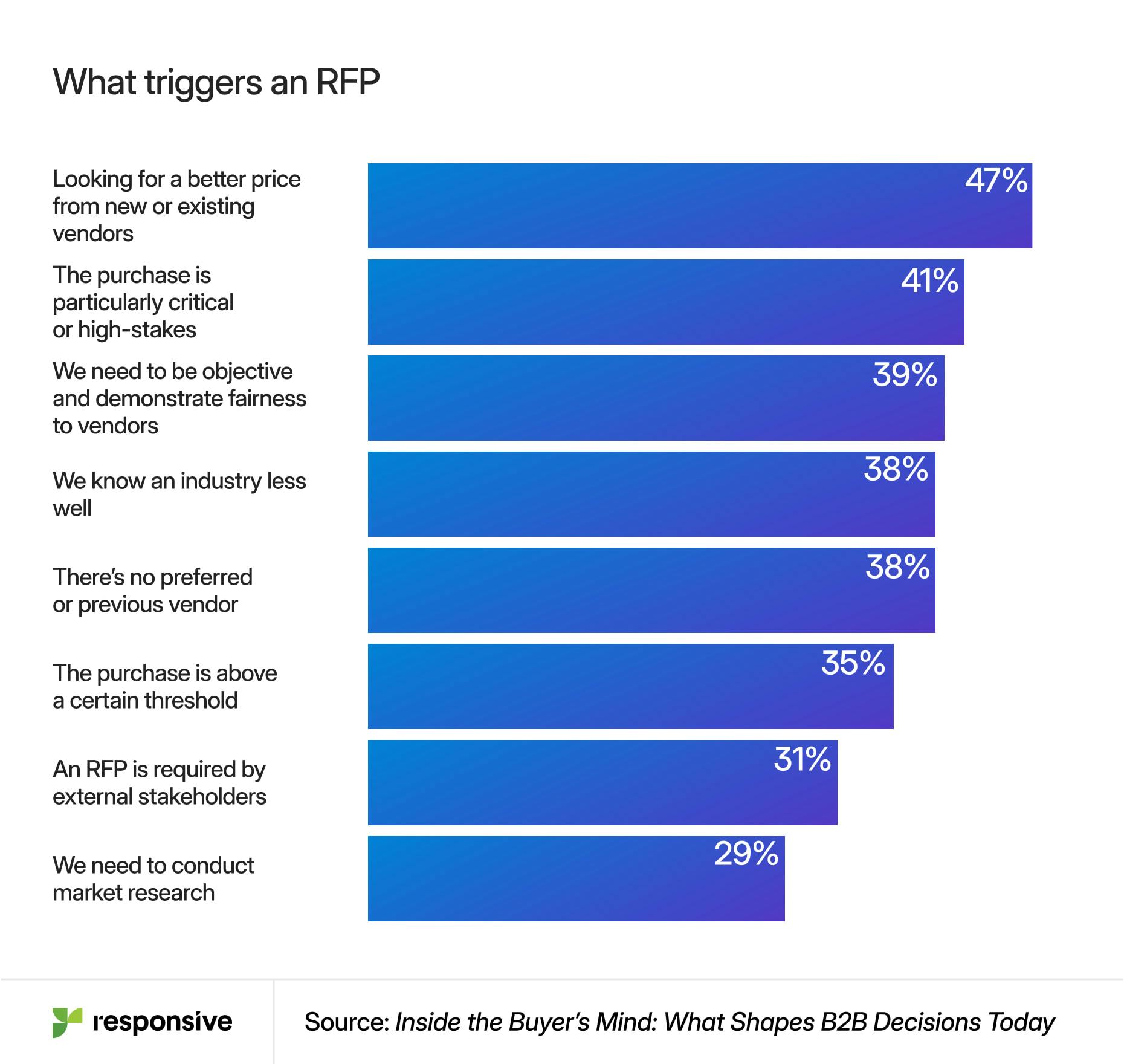

When do buyers issue RFPs?

Responsive’s research found that buyers don’t issue RFPs for every purchase. They most often save them for the moments that demand structure, proof, and accountability.

Nearly half of respondents (47%) said they issue RFPs to create price pressure with new or existing vendors. Another 41% said they do it when a purchase is high-risk or highly visible within the organization.

Buyers also formalize the process to show diligence and fairness:

- 39% do it to demonstrate objectivity

- 38% issue RFPs when they are less familiar with a market or solution

- 38% when there is no incumbent vendor

No one in the survey said they “RFP everything.” Every RFP begins with a reason. Understanding that reason helps vendors tailor their response to the buyer’s true concern: cost, risk, evidence of value, etc.

For revenue teams, this is a strong signal that when an RFP arrives, it likely carries weight. Buyers want proof that the choice they make will stand up to scrutiny.

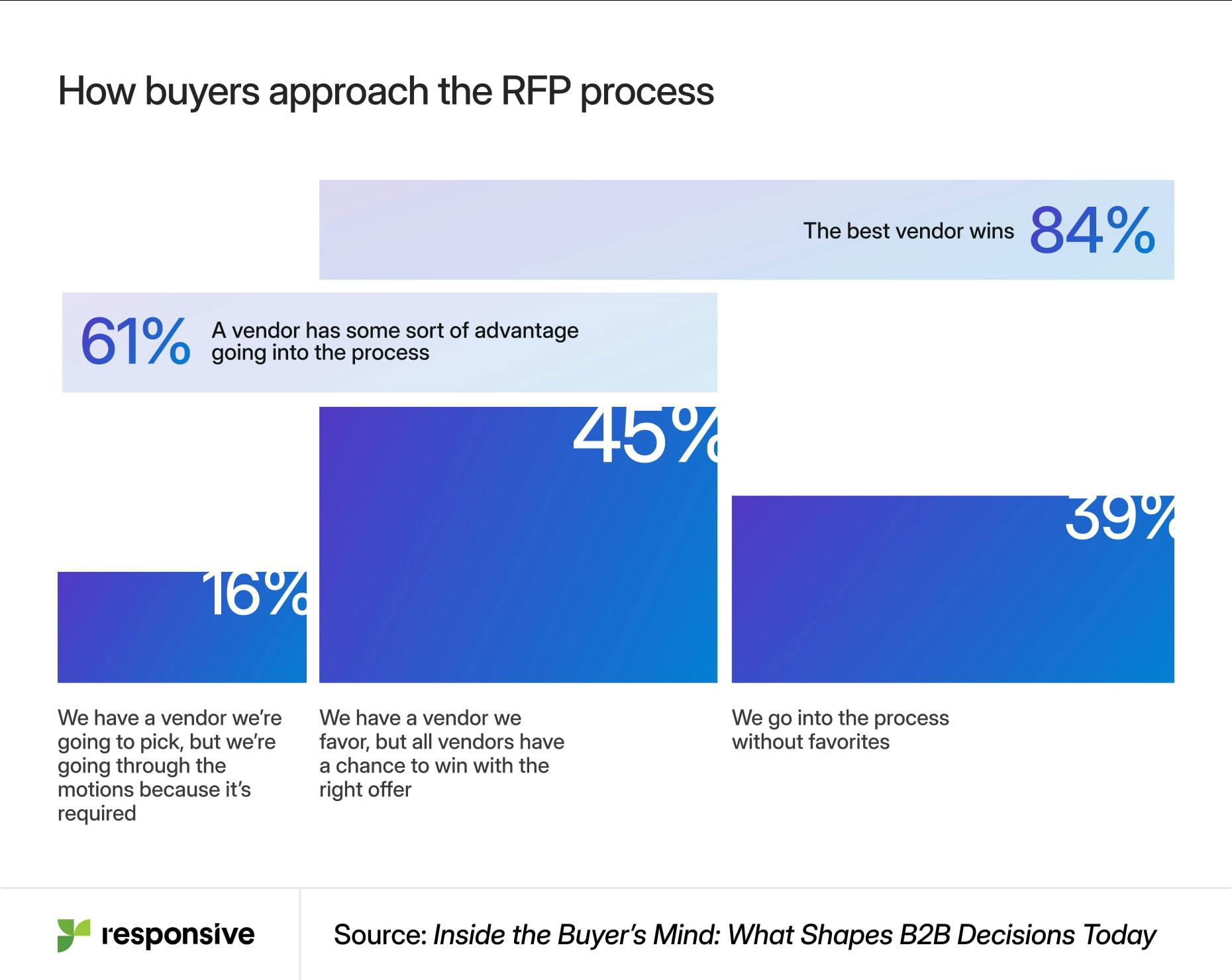

Do buyers already know who they’ll pick before issuing an RFP?

Many do. In Responsive’s research, 61% of buyers said they enter the process already leaning toward one vendor. For some, the RFP confirms that choice. But nearly half of buyers say they’re open to switching from their initial preference.

Industry and geography play a role. In manufacturing, 54% of buyers say they already know who they will select. In the U.S., buyers are more open: nearly half (49%) start without a favorite, compared to only 37% in other regions.

The good news is that performance still matters. 84% of buyers said the best vendor ultimately wins, even when another begins ahead.

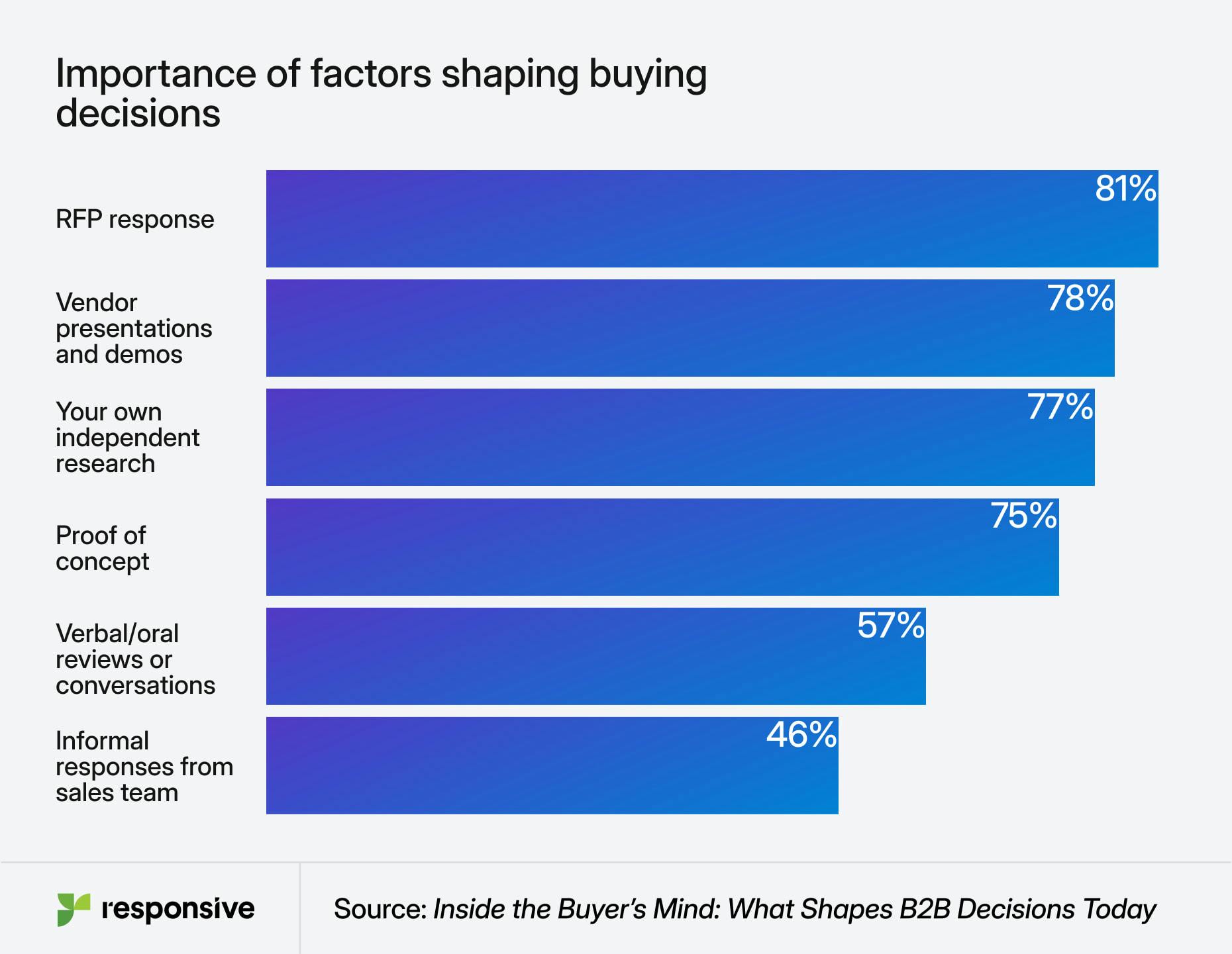

What parts of the buying process or sales cycle carry the most weight?

When we asked buyers what shapes their final decisions, the RFP itself took the top spot.

According to Responsive research:

- 81% of buyers said the RFP carries the greatest influence on which vendor they ultimately choose

- 78% cited vendor presentations and demos

- 77% said independent research has the greatest influence

- 75% called out proof of concept

Buyers distinguished the RFP as the most reliable artifact in the sales cycle. This is when all the promises made earlier in the cycle are put to the test. It’s shared, reviewed, and discussed long after meetings end. It reaches stakeholders who never join a demo or read a case study. The RFP becomes the version of your story that endures inside the buyer’s organizations.

A strong response goes beyond just answering questions to demonstrate accountability, show that the vendor understands the buyer’s priorities, and builds irrefutable confidence in the ability to deliver.

Which factors matter most when buyers evaluate RFPs?

When buyers make their final decision, they look for vendors who understand all aspects of their business: the challenges, regulations, ambitions, and priorities that shape how they operate.

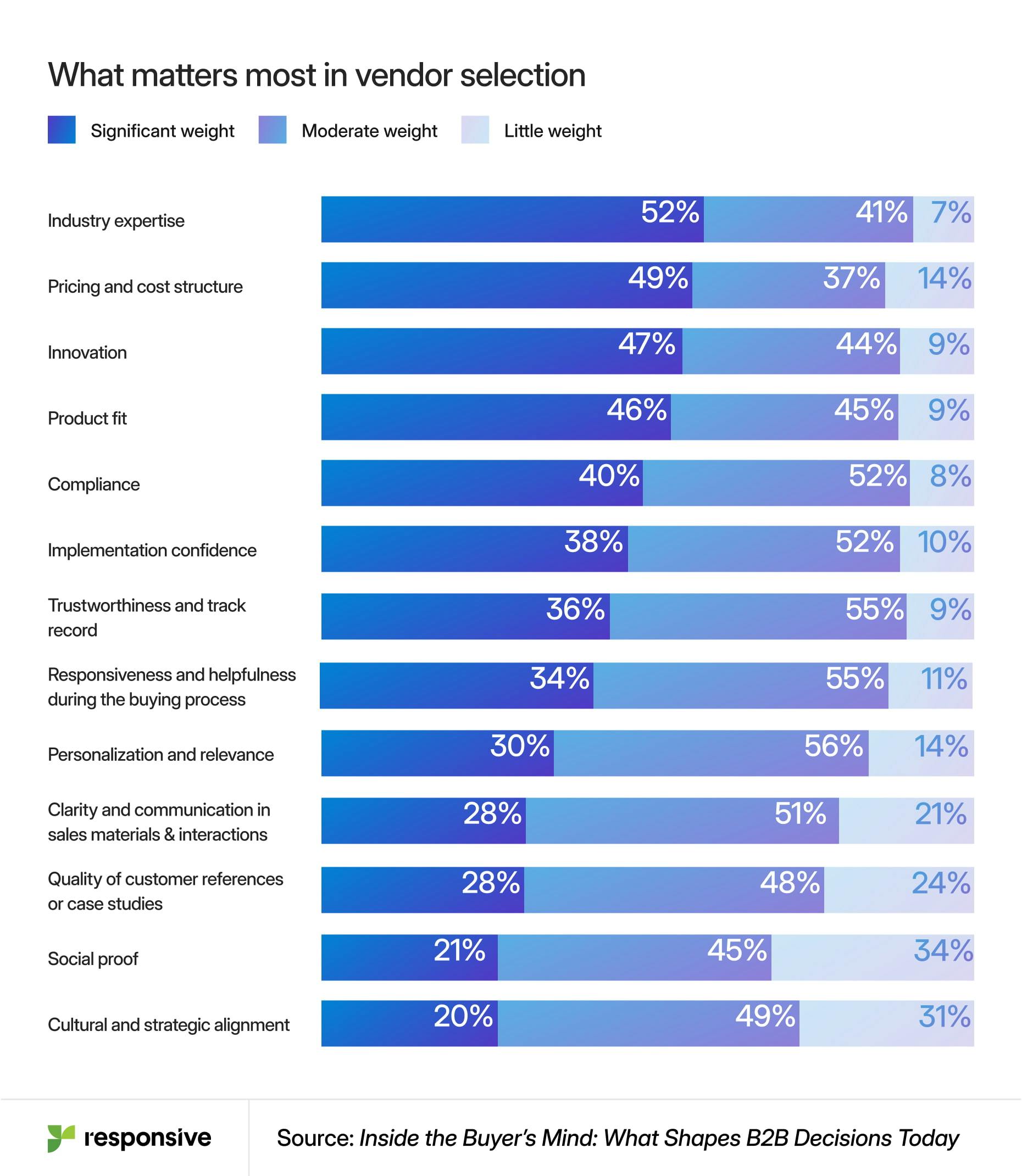

According to the Responsive research, the factor that matters most when buyers evaluate RFPs is industry expertise, cited by more than half (52%) of respondents. Buyers want vendors who can show they understand the realities of their business and the pressures that shape their decisions.

Pricing (49%) and product fit (46%) also weigh heavily, followed by innovation at 44%. Compliance, implementation confidence, and personalization (surprisingly) matter less. Only 30% of buyers named personalization a major factor.

These figures reinforce that the RFP cannot be treated as a checklist item or a test of marketing polish. It’s a critical measure of whether a vendor knows the buyer’s world, can execute reliably, and can make complex information simple to understand.

How is AI changing how buyers manage and evaluate RFPs?

AI is playing an increasingly visible role in how buyers manage RFPs and how they judge responses.

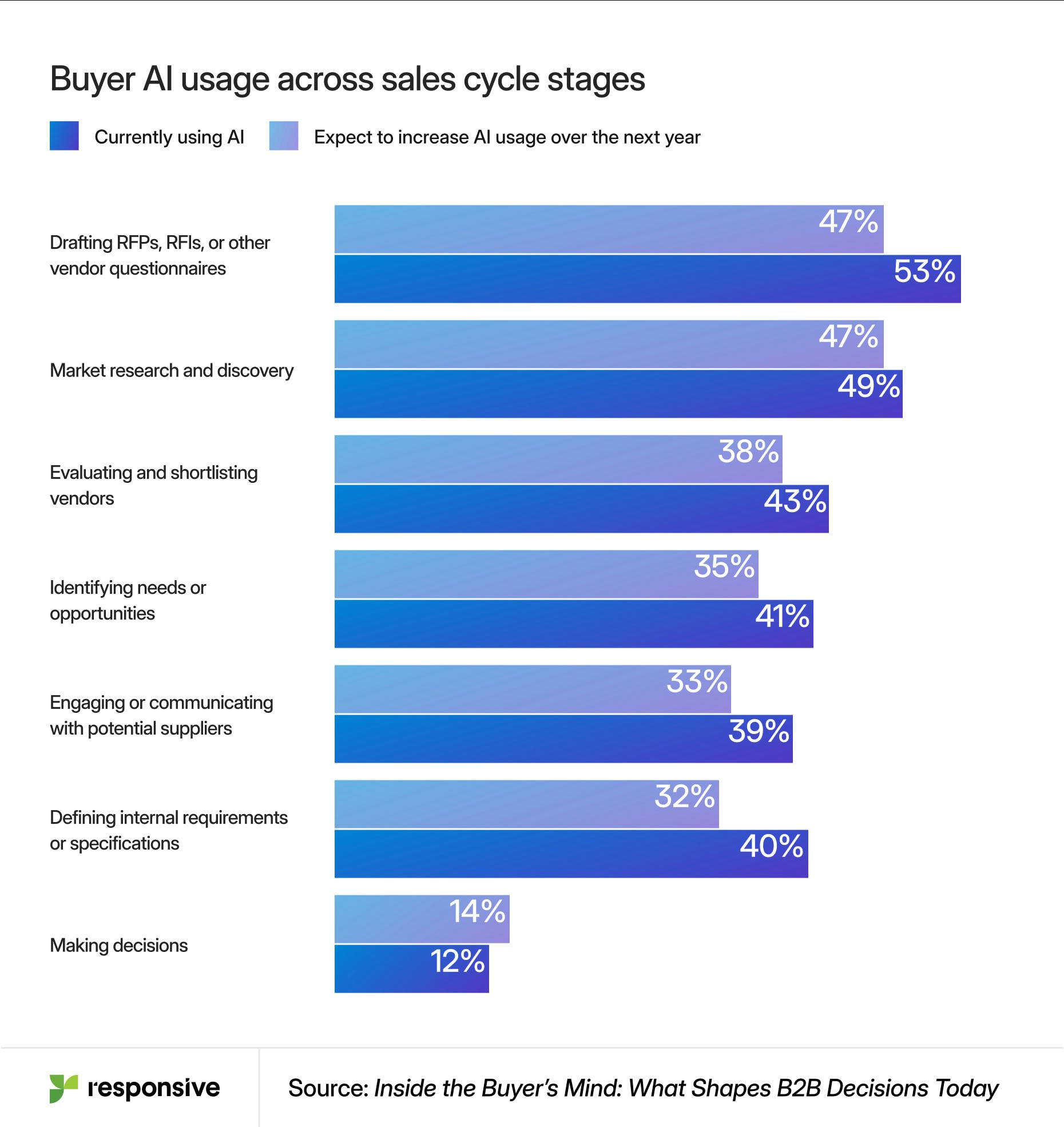

According to Responsive’s report, buyers are already using AI across the cycle, focusing on areas that typically take the most time. Nearly half of buyers (47%) are already using AI to draft vendor questionnaires or to conduct market research. Many also use it for vendor evaluation (38%) and supplier engagement (33%). By and large, buyers expect to significantly increase their use of AI next year.

Some buyers are also using AI to determine whether vendors used AI in the RFP response. 1 in 5 said they already use AI tools to detect whether responses were written or assisted by AI. That number jumped to a whopping 52% in Asia-Pacific.

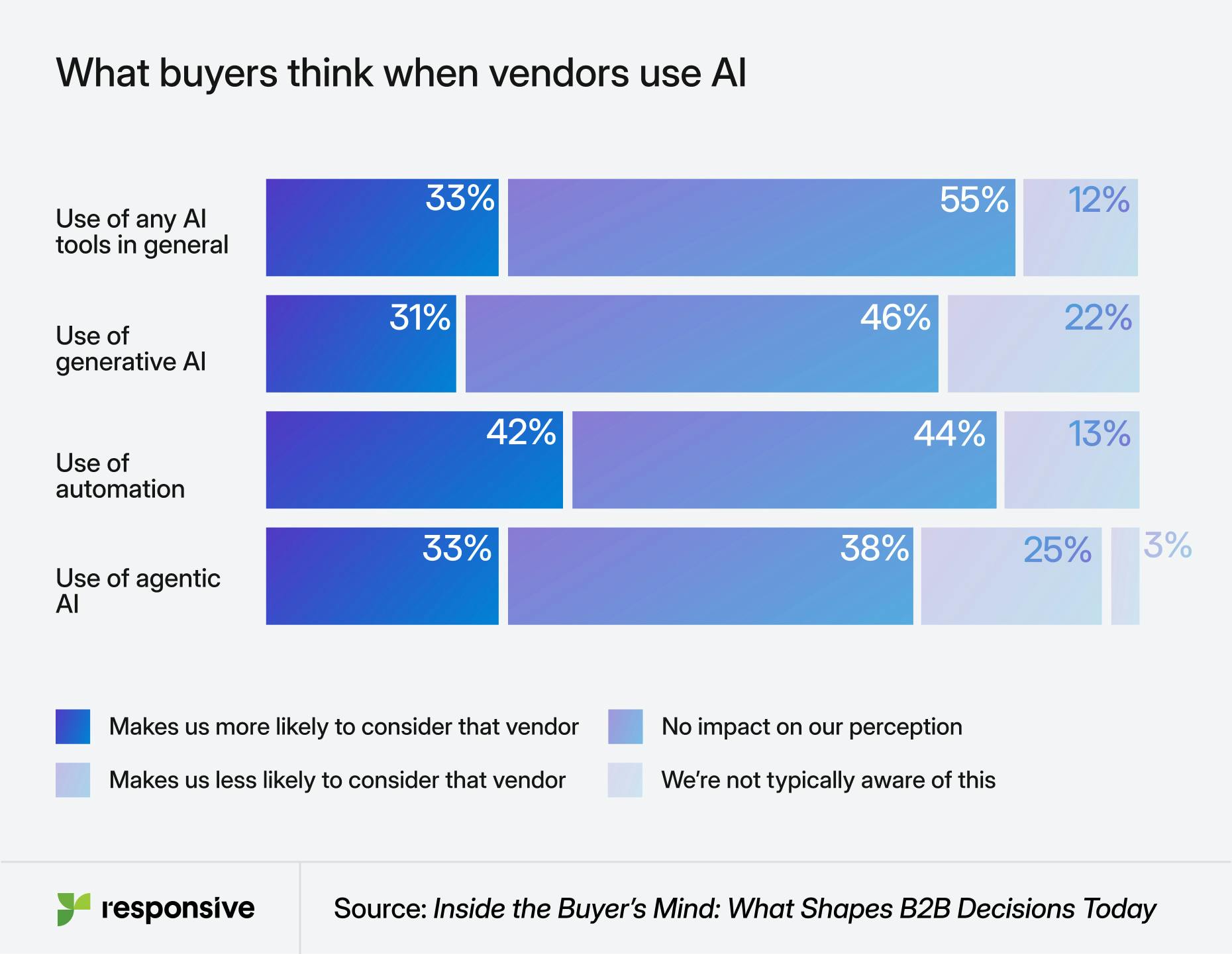

Importantly, most buyers don’t view AI as a negative. 42% said automation improves their perception of a vendor, and one-third said GenAI actually makes them more likely to engage. Many buyers are interpreting AI use as a sign of maturity — evidence that a vendor is forward-thinking, innovative, and actively adapting to how work gets done today.

Where buyers hesitate is when the use of AI feels unchecked. In the UK in particular:

- 62% expressed concern about generic responses

- 56% about data security

- 51% about overreliance on AI

That does not mean AI should stay out of the process. It means vendors need to explain how it fits into their own. When buyers understand that AI improves accuracy, speed, or consistency (with safeguards that mitigate risk) — and that humans still review and stand behind the work — it’s more likely to build trust.

What should vendors take away from this research?

The RFP cannot be treated like paperwork at the end of a deal. It’s the most critical factor shaping buying decisions. The RFP is the proving ground where buyers decide who to trust with their time, budget, and reputation.

Buyers want evidence of expertise, proof of execution, and assurance that technology is being used responsibly. They expect clear, relevant answers and well-documented support for every claim.

AI is changing how fast decisions move, but not what drives them. Buyers still want concrete proof: clear answers, credible expertise, and a response they can trust. The teams that focus on those fundamentals and that use AI to strengthen — not replace — their craft will keep winning as the competition heats up.