B2B buying is undergoing a seismic shift. For sales, marketing, proposal, and revenue leaders — those shaping deals both behind the scenes and on the front lines — 2025 brings both complexity and opportunity. If your team hasn’t already adapted to meet the demands of today’s more informed, more empowered buyers, you’re at risk of falling out of contention.

According to the 2025 State of Strategic Response Management (SRM) Report, more than 75% of organizations say their buyers now operate with tighter budgets, expect faster turnaround times, and demand a much higher degree of personalization. This is not a passing trend. Rather, it’s the new foundation on which all competitive pursuits must be built.

If you want to understand how successful teams are rising to this challenge (and how you can lead the charge within your own organization), read on for a closer look at the most important trends shaping B2B pursuit strategy today.

Download the full report

Buyers are smarter, scrappier, and more strategic

B2B buying has always been complex, but in 2025, it’s reached a new level of speed, scrutiny, and self-sufficiency. Decision-makers have become more independent in their research, more selective in vendor engagement, and increasingly reliant on AI tools to influence their procurement processes.

Here’s what the data shows:

- Later engagement in the buying cycle: Buyers are researching more before they engage a vendor, meaning it’s more important than ever that your content and collateral are accurate and convincing.

- Larger buying committees: The average B2B deal now involves more stakeholders, each with their own set of criteria and concerns.

- AI-powered evaluations: 59% of organizations report seeing buyers use AI to draft and analyze RFP responses, and a full quarter say it's directly impacting their win rates.

- Higher demand for personalization: 75% of organizations say buyers now require a significantly greater level of personalization in the responses they receive.

For those in charge of proposals and strategic responses, this moment demands more than operational excellence. It requires a rethinking of how content, context, and customization come together. Precision and personalization are now prerequisites, not luxuries.

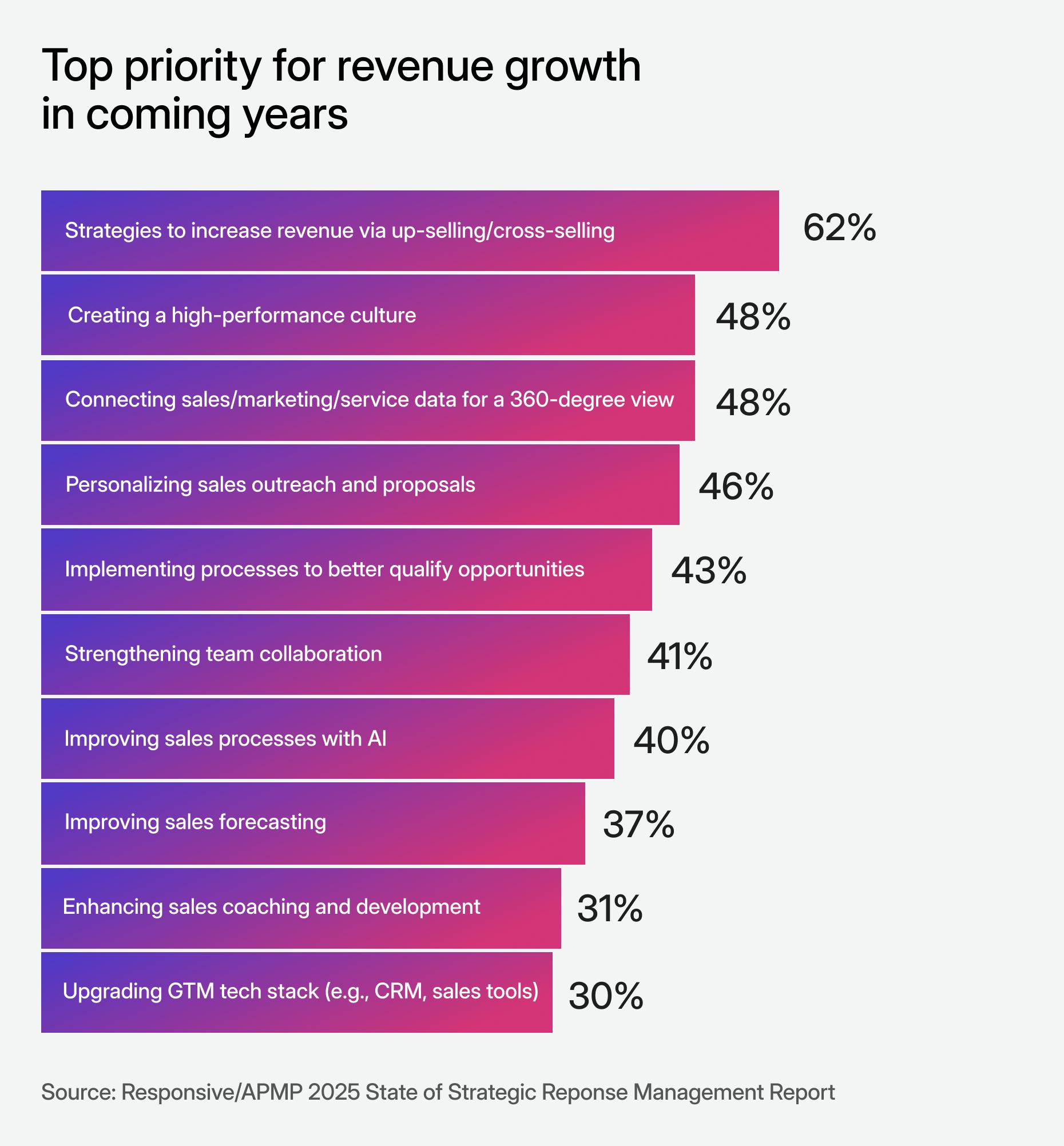

Upselling and cross-selling are top priorities

With a rise in buyer independence and complexity, new customer acquisition is becoming more tricky and cost-intensive, prompting many organizations to double down on existing relationships. As a result, 62% of companies are prioritizing upsell and cross-sell motions as core growth strategies, according to the report.

Expanding within current accounts builds on existing trust and established value. Done right, it accelerates revenue and strengthens retention.

But this approach also raises the bar for internal readiness. Teams need:

- Unified, accessible customer intelligence

- High-quality, consistent execution across every touchpoint

- A culture of performance and accountability

The most effective teams are proactively setting the stage for scalable growth. They’re building systems that surface opportunities faster and propel follow-through. Strategic Response Management plays a central role — bringing people, processes, and technology together to make growth more repeatable and less reactive.

Align executives and those on the frontlines to avoid missteps

One of the clearest tensions highlighted in this year’s report is the divide between how executives and practitioners prioritize SRM:

- Executives are focused on long-term initiatives like cultural transformation (52%), scalable processes (47%), and connected systems (42%)

- Practitioners prioritize execution-focused needs such as better qualification (46%), improved collaboration (45%), and clearly defined ownership (43%)

While these differences are logical, they point to an ongoing challenge: how to bridge strategy with operations.

Bridging this gap starts with mutual visibility and respect. Leaders must understand the friction practitioners face daily, while frontline teams benefit from seeing (and demonstrating) how their work ties into broader transformation goals. When strategic intent meets operational clarity, teams move with greater precision and purpose.

Organizations that foster this alignment aren't just better equipped to respond, but they're better poised to lead.

Strategic responses are revenue drivers

Strategic response work — proposals, RFPs, DDQs, questionnaires, and more — can no longer be viewed as a support function that’s taken for granted. It’s a growth engine.

Last year’s report revealed that nearly half of company revenue is tied to strategic responses. In this year’s 2025 State of SRM Report, we found that 62% of organizations saw YoY revenue growth from proposal-related work.

These numbers make clear that proposal and strategic response functions are essential to revenue growth. Yet while expectations are rising, resources and clarity are not always keeping pace.

83% of frontline practitioners say their roles are under increasing pressure. By contrast, only 70% of executives acknowledge that pressure. This disconnect speaks to a broader need for executive awareness and support. Strategic response professionals are navigating more volume, complexity, and expectation, often without proportional investment or alignment.

That tension becomes even clearer when it comes to AI. While 72% of executives believe proposal teams need to evolve due to AI, just 58% of practitioners agree. The disparity suggests executives may be anticipating rapid AI transformation, while practitioners are still grappling with its day-to-day implications. When strategy is set at the top without a clear understanding of execution on the ground, misalignment is inevitable.

What AI adoption looks like in winning teams

The instinct to invest in technology is understandable — and widespread. However, looking at the data, this impulse to over-index on technology is potentially damaging.

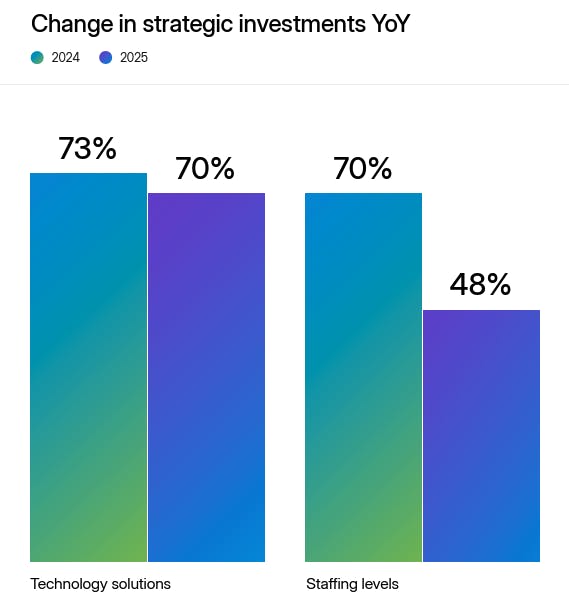

Technology investment has held steady across organizations year-over-year — but not all investment strategies are equally effective. According to the report, staffing investment overall is declining. Only 48% of respondents increased bid and proposal staffing this year, compared to 70% last year.

Yet the most successful organizations — the ones that are growing in revenue by more than 25% YoY (Leaders) — aren’t cutting corners on people. They’re balancing their AI spend with headcount growth.

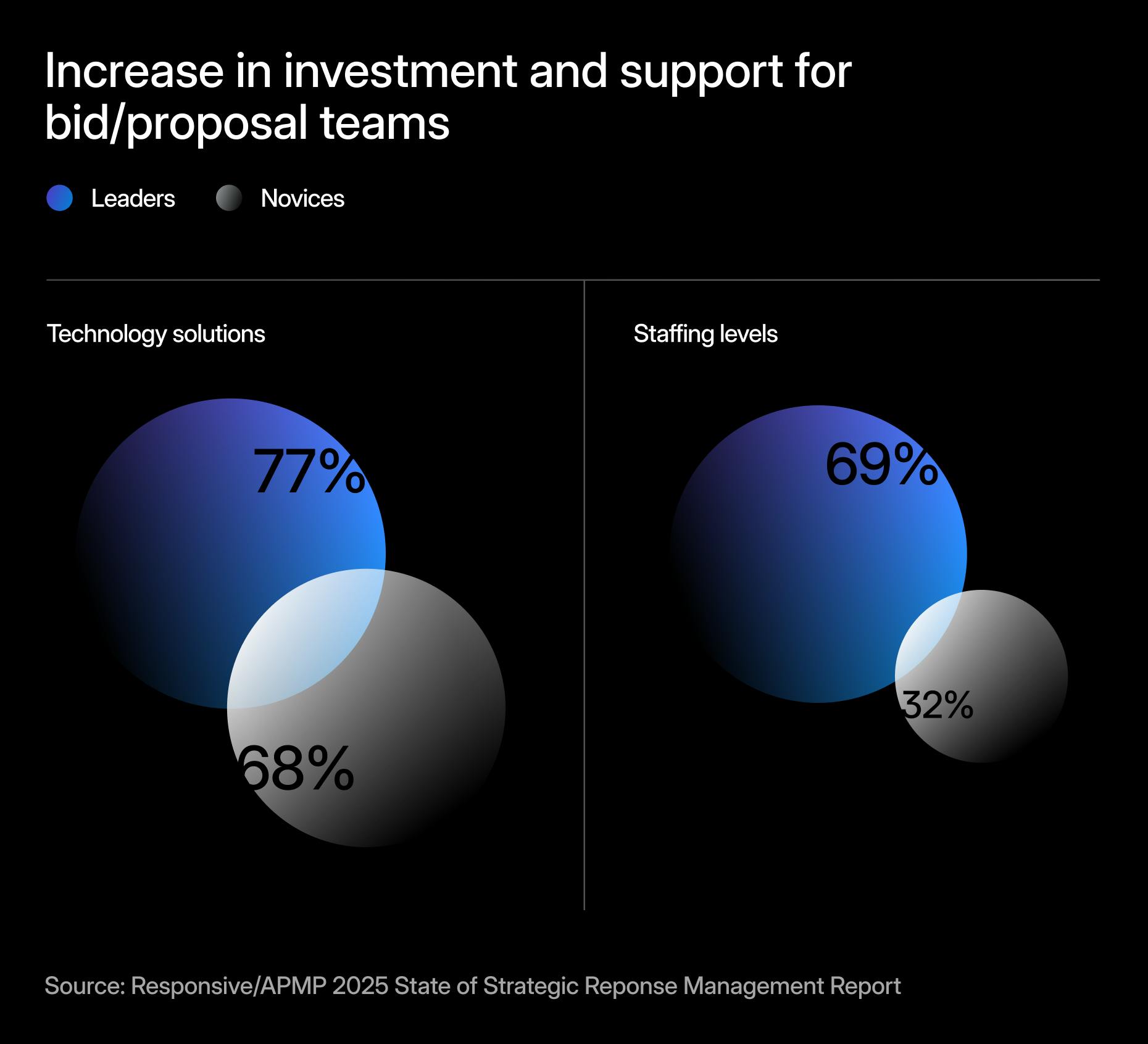

77% of Leaders are increasing tech investment, but 69% are also growing headcount. By contrast, Novices are less than half as likely to invest in staffing, despite facing the same external pressures.

This balanced investment model demonstrated by top-performing companies matters. Leading organizations are using AI to accelerate — not replace — human expertise. Leaders understand that technology alone isn’t a silver bullet. It’s the pairing of smart tools and skilled people that drives sharper decisions, better pursuit strategies, and higher win rates.

AI is no longer a future-facing concept. It’s a daily reality in B2B buying and selling — and leading teams are treating it as such. According to the SRM Report, organizations that have fully deployed AI agents across their SRM workflows are 6X more likely to report strong performance.

But the advantage isn’t in automation alone. It’s in the way AI supports better decision-making, faster content assembly, and more targeted personalization.

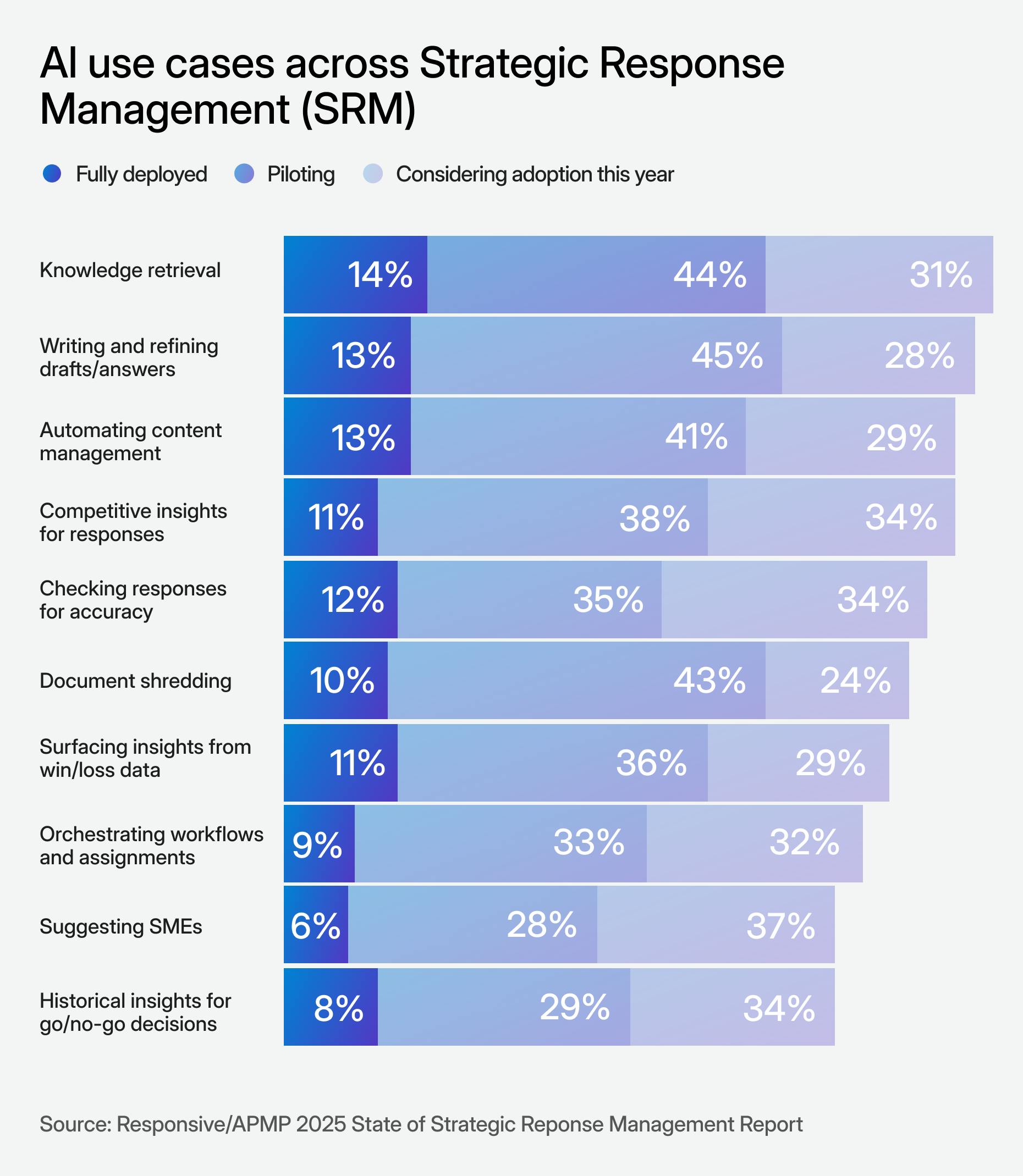

The most common active AI use cases include:

- Retrieving relevant knowledge quickly and accurately

- Document shredding

- Drafting and refining responses at scale

- Tagging, organizing, and cleaning up content libraries

By combining human insight with machine precision, these teams are elevating their strategic responses and positioning themselves to win more often.

Your next move to adapt to 2025 B2B buying and selling trends

The pace and pressure of B2B buying and selling isn’t slowing down. But that doesn’t mean teams need to run faster. It means they need to work smarter, aligning strategy, talent, and technology to meet the moment with confidence.

Responsive’s 2025 State of Strategic Response Management Report offers a blueprint. It’s a comprehensive look at what top-performing teams are doing right now to turn complexity into competitive advantage.

Get the full report to explore the strategies, benchmarks, and tools redefining what excellence looks like in modern B2B buying and selling.