Deals are won and lost when you’re not looking.

RFPs, demos, and negotiations matter. But if you think that’s the whole game, you’re missing where real decisions take shape. Buyers are weighing options, aligning internally, and setting preferences long before revenue teams ever get a shot. And even after you’re in the room, the process continues in conversations and evaluations you’ll never see.

To pull back the curtain on those hidden dynamics, Responsive surveyed 350 B2B buyers across the globe for our latest report, Inside the Buyer’s Mind: What Shapes B2B Decisions Today. It uncovers where buyers spend their time, what drives short lists, how AI is changing the game, and the signals that can tip the outcome in your favor.

The full report is now available for download. Keep reading here to get the highlights.

Download the full report

The invisible kickoff

For most buyers, the process starts quietly — and early. According to the report, 90% conduct research before ever speaking with a vendor. More than half say they do “a lot of” or “extensive” research. By the time your team hears from a prospect, the race is already half run.

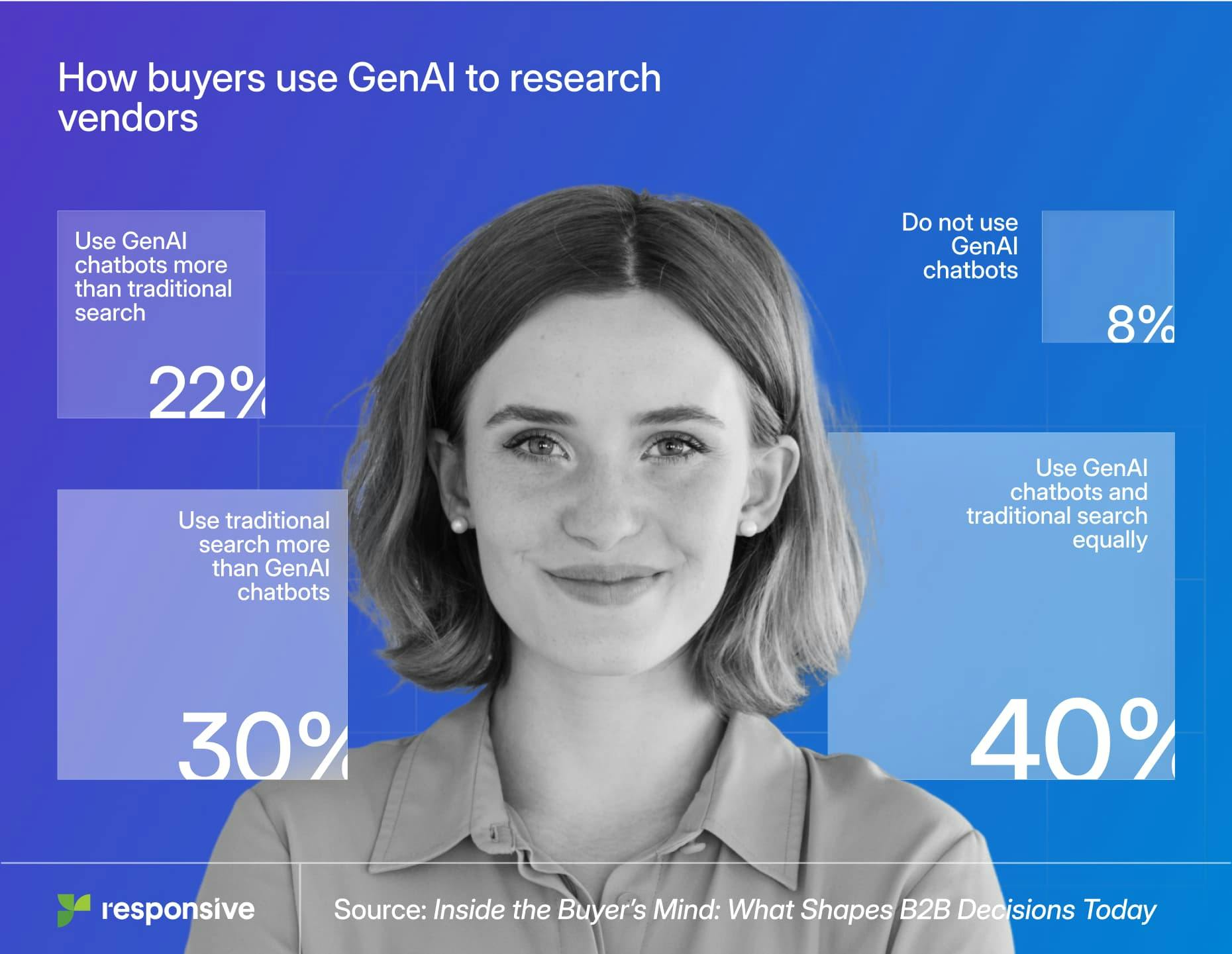

Where buyers look is rapidly changing. Search engines and peer recommendations still top the list, but a new player is reshaping discovery: GenAI. One in three buyers now use AI chatbots to surface vendors, and in the technology sector, that number jumps to more than half. In the U.S., almost half of buyers (48%) say they’ve used GenAI tools to discover vendors — a striking sign of how fast research behavior is evolving.

This is where early visibility is earned or lost. When buyers use AI tools to compare vendors, those tools rely on the information your organization makes public: your website, trust center, case studies, and product documentation. If these sources are incomplete or inconsistent, AI models may not represent you accurately.

Being discoverable now means being legible, to both people and machines.

Where the deal turns

Even after thorough research, most buyers aren’t locked in. 61% say they begin with a preferred vendor, but nearly half say they’re open to switching.

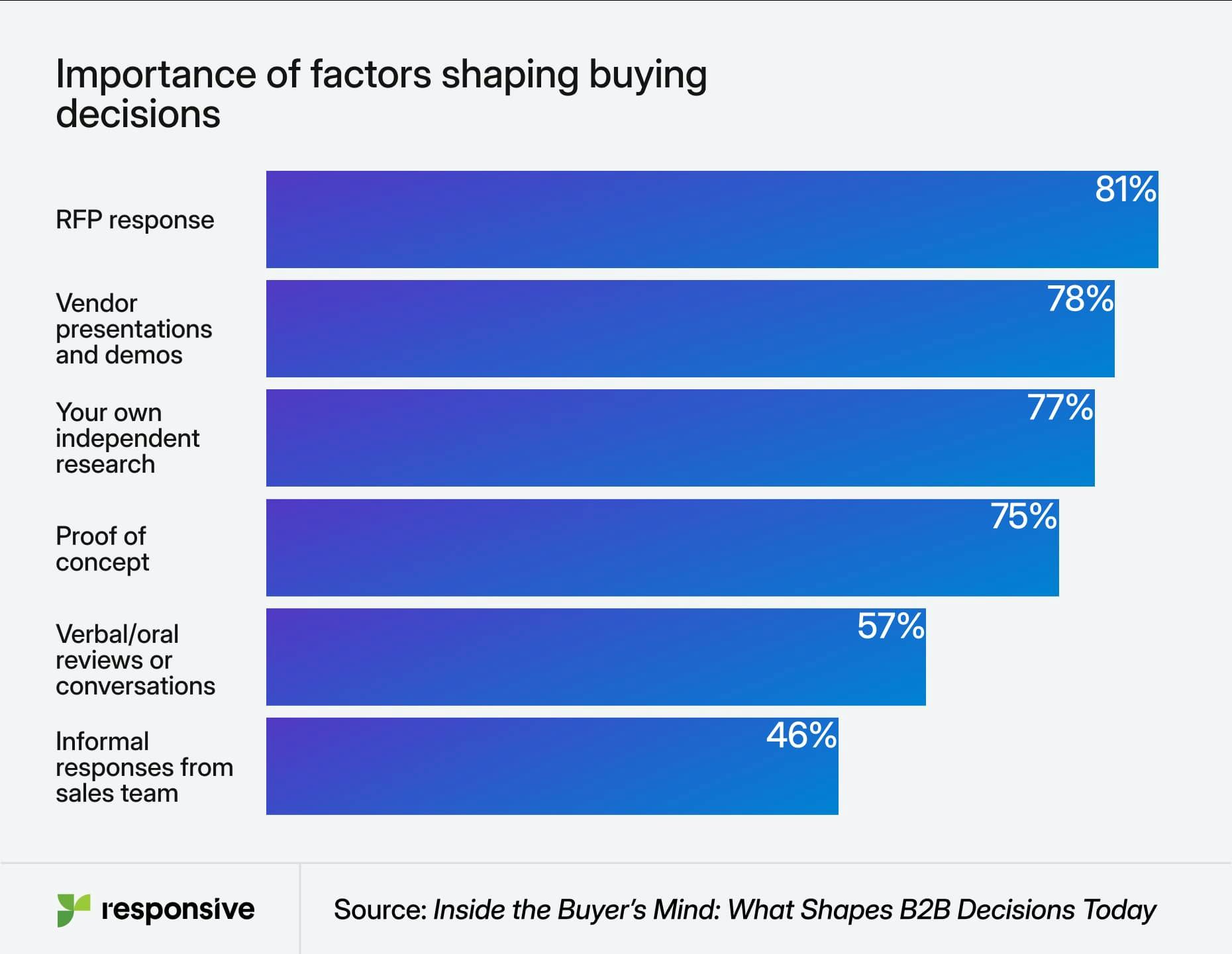

What changes their minds? Buyers say RFPs are the single most decisive factor in their final choice. They see them not as paperwork but as proof of how well a company listens, understands, and delivers on what matters most.

Organizations that treat RFPs as strategic communication and not as compliance exercises are the ones who will win out. They connect expertise to relevance. They write with clarity and confidence. And they use centralized, well-governed knowledge so that every answer is informed and consistent.

AI at the table

The report revealed that buyers aren’t just using AI to find vendors, but, increasingly, they’re using it to assess them. Buyers are already using AI in the stages that take them longest (discovery, evaluation, and supplier engagement) for tasks like drafting RFPs, market research, and shortlisting.

And buyer AI usage is slated to climb. More than half of the buyers surveyed say they expect to increase their AI usage over the next year.

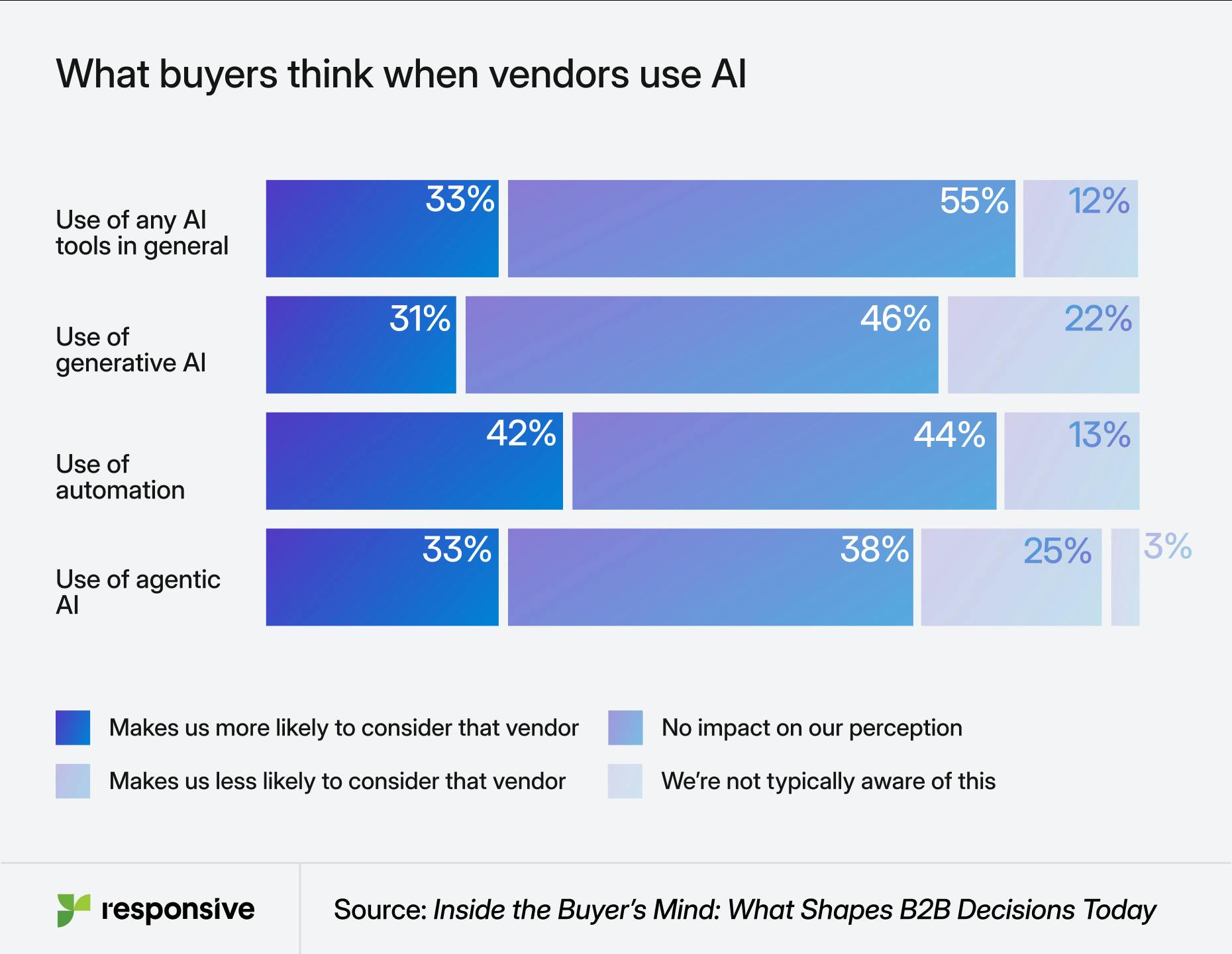

When it comes to vendor usage of AI, most don’t view it negatively. In fact, nearly 1 in 3 say GenAI makes them more likely to consider a vendor, and automation is seen even more favorably — 42% say it improves perception.

Buyer sentiment around vendor AI use is largely neutral or positive. Many buyers interpret it as a sign of maturity, evidence that a vendor is forward-thinking, innovative, and actively adapting to how work gets done today.

Closing the gap between what buyers do and what revenue teams see

Across industries, the buying process has splintered. Multiple teams influence the outcome, and the channels shaping perception are multiplying. Inside the Buyer’s Mind: What Shapes B2B Decisions Today shows how discovery, evaluation, and trust now all rely on shared, structured knowledge across an organization.

Here’s what’s true today:

- Discovery happens everywhere. Buyers find vendors through search, peer referrals, and increasingly, GenAI chatbots that summarize information from across the web.

- Content carries further than conversations. RFP answers, security documentation, and customer case studies circulate inside organizations long after meetings end.

- AI amplifies what’s already true. Clear, accurate, and well-structured knowledge is surfaced more often (and faster) by both humans and machines.

- Visibility is collective. The insights once siloed in proposal libraries or security portals now shape marketing, sales, and customer success. Consistency across these teams is the new baseline for credibility.

Strategic Response Management sits at the center of that ecosystem. It connects what your teams know to how your buyers find, evaluate, and choose you.

The 2025 State of Strategic Response Management Report

What this means for 2026

Across stages, B2B buyers are operating in new ways. The shifts we unveiled in this report are rearchitecting the sales process. They reflect changes in when buyers engage, how they compare vendors, and what ultimately drives their decisions. For revenue teams, closing the gap means spotting these shifts early and advancing yourself at the moments that matter most.

Inside the Buyer’s Mind will arm you with a hidden advantage by showing you where buyers are spending their time, what they prioritize, and how they make their pick.