If AI hasn’t yet changed your day-to-day, chances are that it will soon. Of the financial services decision-makers that participated in the 2025 State of SRM: Financial Services Industry Report, only 6% said they’re NOT deploying AI agents in the near future. In other words, 94% are already moving. IF your competitors are among them, how long before “not yet” becomes “too late”?

Across the asset management industry, firms are facing mounting information requests, limited bandwidth, and increasing client scrutiny. Keeping up with increased volume and complexity without adding headcount to already overburdened RFP and DDQ teams will require AI. Fortunately, Responsive has created a guide to help you get started.

The Guide to AI in Asset Management

The case studies we explore below are also featured in The Guide to AI in Asset Management, which compiles best practices we’ve established by helping nearly 250 asset management firms around the world deploy AI.

The guide also includes:

- A step-by-step playbook to implement 10 AI features

- Analysis of the AI adoption landscape in the industry

- Questions you should ask any AI solution provider to ensure your data, clients, and firm are protected

The Guide to AI in Asset Management

How firms put AI to work

Understanding the potential of AI to help teams manage knowledge, automate responses, and scale access to trusted content is critical. Still, AI impact isn’t real until you see how it works in real-world scenarios. These case studies spotlight firms that have gone beyond exploration, using Responsive AI to meet client demands, free up capacity, and deliver faster, more accurate responses.

The firms featured here face the same challenges many asset managers encounter, including mounting requests, limited resources, and rising client expectations. Their stories demonstrate how operationalizing AI for Strategic Response Management transforms experimental concepts into executional impact.

Centralizing content for AI readiness

Customer profile: Global asset management firm with $1T+ in AUM

AI impact: With AI recommendations and conversational AI:

- 85% of questions were answered by AI, reducing time spent searching for content.

- 78% of AI chats were answered, indicating substantial self-service utilization for more than three-quarters of ad hoc and proposal-related questions that were resolved efficiently and accurately.

AI output is most effective when the AI draws only from accurate, updated content. A clean Content Library successfully powers Responsive Ask, the conversational AI that lets field teams self-serve AI-generated content from anywhere. Further, the same clean Content Library also supports AI agents. Think of it in terms of fuel options for a high-performance car. Regular may work, but eventually performance will lag and the engine will start knocking. Start and stick with premium-grade fuel to ensure high performance and clean running even after heavy usage.

“This client overhauled their Content Library to make sure AI was pointed at the right information. Their hard work has really paid off, and the client is now taking advantage of all of our AI features. They’re also in the process of trialing multiple AI agents, which will reduce team workload even more.”

Scott Evans

Customer Success Manager at Responsive

When AI trust is the #1 priority

Customer profile: European investment firm with $8B+ in AUM

AI impact: The investor relations team needed AI to respond faster and more consistently to DDQs and other information requests. However, AI output had to include citations and be easy to validate against trusted sources.

In heavily regulated industries such as finance, accuracy and compliance are critical to any response, whether it’s human or AI-generated. AI-powered SRM platforms like Responsive are advantageous in this area because they rely on approved content, keep humans in the loop to sign off on submissions, and include AI output validation features such as TRACE Score™ (a trust rating of AI output on a scale of 1-100) and Quality Check.

“AI efficiency was critical in their evaluation. TRACE Score™ gave them incredible confidence, and they stated that no other vendor could match it.”

Iain Walker

Regional Director at Responsive

Upgrading to client-ready AI

Customer profile: Middle-market investment firm with $6B+ in AUM

AI impact: The firm’s former DDQ software automation provider lacked AI functionality. Responsive AI generates DDQ first drafts to save time and turn around responses faster, even as volumes increase.

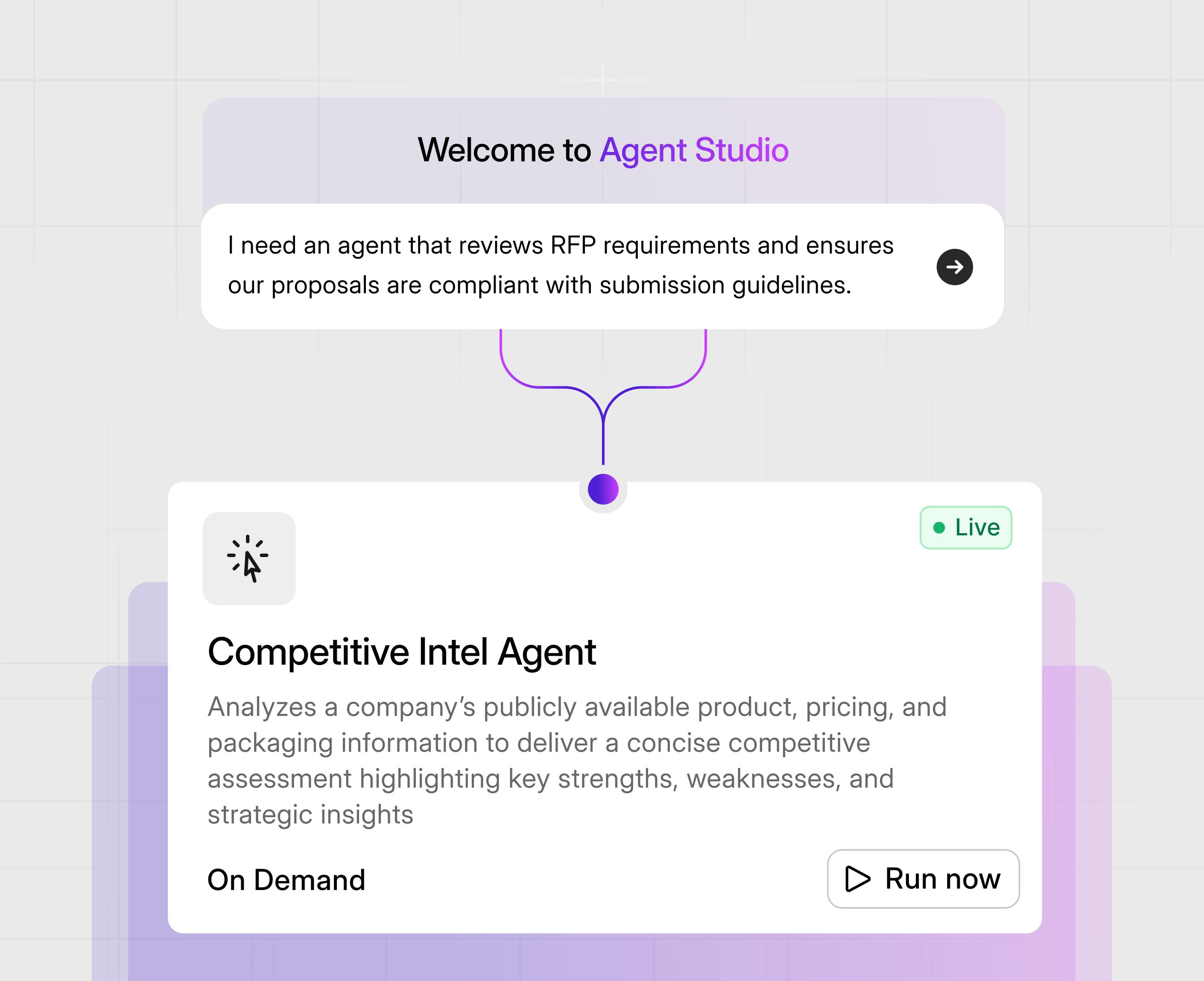

Responding to investor and consultant requests in asset management is a multi-step effort, and AI agents now support that work for DDQs and the rest of the asset gathering lifecycle. On the Responsive Platform, these agents operate together, passing context and tasks from one to the next to accelerate intake, drafting, and delivery.

“Seeing the Answering Agent build a first draft in seconds really opened their eyes to the possibility of how much AI will help them with their DDQs.”

Andrew Mofford

Senior Account Executive at Responsive

Automating hundreds of manual work hours

Customer profile: Life sciences investment firm with $5B+ in AUM

AI impact: Responsive AI saved hundreds of hours of manual work per year spent on DDQ/ODD workflows.

The time savings this client achieved came from AI-driven automation across DDQ drafting, content management, and workflow coordination. Responsive centralizes DDQ content, teams, and approvals in one secure platform, creating a single source of truth for every response. Responsive AI agents automate repetitive work, analyze complex questionnaires, draft accurate answers, and flag any content that falls outside compliance parameters. Built-in collaboration tools keep investment, compliance, and client-service teams aligned. These benefits extend beyond time savings to improved relations with clients, who feel better served by prompt, or even proactive, and personalized responses.

“The team compared Responsive to competitors, but our AI was way ahead of everyone else’s, and what we could offer in onboarding and support gave us the advantage.”

Nate Perrine

Account Executive at Responsive

AI agents for increasing request volume

Customer profile: Middle market private equity firm with $17B+ in AUM

AI impact: This firm needed AI agents to help manage its high volume of RFPs and DDQs and automate maintenance of its content library.

Asset management firms face relentless demand for RFPs and DDQs, each requiring precision and compliance. Responsive AI agents automate first drafts, flag risks, and keep responses grounded in approved content. They maintain an audit-ready content library of automatically updated, cleaned, and tagged information as regulations and data evolve. By orchestrating workflows and reducing manual effort, Responsive helps teams deliver faster, more accurate submissions.

“Responsive outperformed competitors based on our value metrics, advanced automation, and AI agent capabilities.”

Bruce Duffett

Account Manager at Responsive

Verbatim removes AI accuracy doubt

Responsive Verbatim is AI that knows when NOT to write. It’s a purpose-built AI capability for firms that cannot afford to compromise on accuracy, auditability, or control.

In asset management, even minor wording changes can trigger major compliance risks. Under the SEC’s Marketing Rule, reused content, such as RFP and DDQ responses, must remain fair, balanced, and properly contextualized. If generative AI modifies a disclosure or performance qualifier, the response could fall out of compliance and require a full review cycle.

Verbatim solves this challenge by allowing firms to lock approved language, including phrases, disclosures, or statements that must appear exactly as written. This ensures AI never rewrites or paraphrases critical content, preserving regulatory integrity.

From there, Responsive AI draws on the rest of the trusted Content Library to generate accurate, compliant, and tailored responses for every other section.

Take Verbatim for a spin

Closing the loop between AI and action

These case studies show what happens when AI moves from pilot to deployment. Firms that once spent hours searching for content or validating responses are now using Responsive AI to generate accurate drafts in seconds, trace every answer to a trusted source, and scale output without expanding headcount.

“We really like the answering agent, Ask, and the general AI functionality in the library. I have not had the chance to test all agents, but this is really the way forward. The RFP world as we know it will be overhauled in 3 years' time, and both as the RFP tool owner and an RFP team, we need to be ahead of the curve.”

Large enterprise capital markets companyAs we point out in The Guide to AI in Asset Management, “For firms hoping AI will, as McKinsey & Co. puts it, ‘leapfrog profitability levels,’ Strategic Response Management (SRM) technology is the closest to turnkey AI available today. SRM platforms like Responsive give asset managers a secure, production-ready foundation to apply AI to revenue-critical workflows, from DDQ automation and content governance to RFP drafting and go/no-go analysis.”

AI’s promise is limitless, and you could start a second career exploring what’s possible. But to make an impact at your firm — to fulfill an AI mandate, improve investor relations, increase asset gathering success, or a combination thereof — you have to operationalize AI now. And the fastest way to do that is with an AI-powered Strategic Response Management platform. You should see what one can do for your firm.