Which of the following AI concerns have been raised at your firm?

- “Our regulatory reality makes AI difficult to use the way we want.”

- “Generic AI can’t be audited or safely rolled out.”

- “It will take far too long to get AI approved for the RFP/DDQ team.”

- All of the above

All of these — even “All of the above” — are common refrains for financial services organizations that take a cautious approach to AI adoption. Only 13% of financial services firms have fully deployed AI in their RFP or DDQ processes, according to the 2025 State of SRM: Financial Services Industry Report. The rest are still piloting, evaluating, or waiting for an AI solution that compliance can comfortably approve.

Why financial services firms need AI now more than ever

The Financial Services Industry Report also found that 90% of firms report that clients expect quicker turnarounds on RFPs, DDQs, and ad hoc client questions. But when content is scattered, experts are spread across teams or locations, and multiple requests are in motion, meeting those expectations without AI becomes nearly impossible, especially under tighter budgets and leaner headcount.

The hundreds of financial services firms using an AI-powered Strategic Response Management platform like Responsive are already seeing:

- Approved, democratized knowledge bases that stay current through AI-assisted management

- Faster, compliant first drafts that meet brand and regulatory standards

- Consistent, audit-ready language across every RFP, DDQ, and client response

- Unified collaboration in a single workspace

- More thorough investor and client communication through early adoption of AI agents

Growth in financial services depends on how well firms capture, protect, and apply what they know. With Responsive AI, firms turn knowledge into a living asset that drives every pursuit. Compliant information is easier to find, govern, and share, ensuring trust in every response and every decision. And with AI features that bring expertise directly into daily workflows, firms can scale confidently to accelerate growth, automate due diligence, and deepen client relationships.

“It is a great experience to see how [Responsive] has integrated AI in the tool. This is the way the RFP industry will move, and early players will be rewarded, late followers put at risk. I also really appreciate Responsive being one step ahead, speaking about AI agents when others only slowly integrate language models.”

Large enterprise capital markets companyIntroducing Verbatim: AI that knows when not to write

Enter Verbatim, a purpose-built AI capability for firms that cannot afford to compromise on accuracy, auditability, or control.

AI rephrasing might seem harmless, but in financial services, even subtle changes can create major compliance issues. Under the SEC’s Marketing Rule, reused client communications — like RFP or DDQ answers — must remain fair, balanced, and properly contextualized. If generative AI adjusts a disclosure or performance qualifier, the entire response may require re-review or re-approval.

Verbatim allows firms to lock approved phrases, disclosures, and statements that must remain word-for-word, ensuring nothing critical is rewritten or paraphrased by AI. Responsive AI then uses the rest of the trusted Content Library to quickly generate accurate, compliant, and personalized answers across the remaining sections of an RFP, DDQ, or any other questionnaire.

Asset managers and investor relations teams get the best of both worlds: AI-powered speed and personalization, as well as absolute consistency and control where precision matters most.

Take Verbatim for a spin

Why more firms trust Responsive AI

Responsive has helped more than 250 financial services organizations managing trillions in assets under management deploy AI. As the leading Strategic Response Management platform, Responsive provides AI features that cater to heavily regulated industries.

- Data privacy by default: Your content never trains external models.

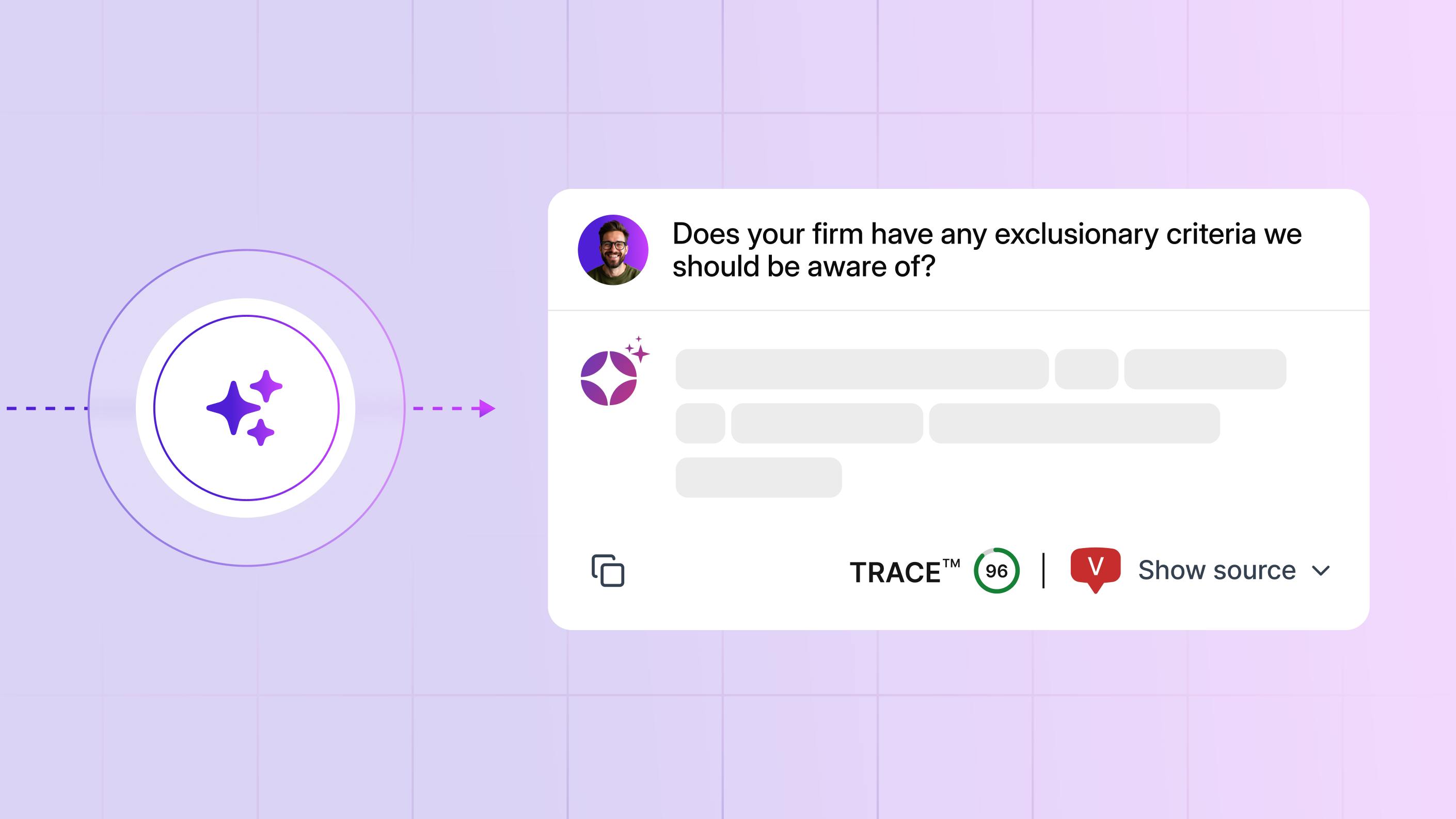

- Explainable AI outputs: Every generated response includes a TRACE Score™ (a trust rating of AI output on a scale of 1-100), Quality Check, and clear citations to validate accuracy.

- Audit-ready documentation: Compliance, legal, and investor relations teams can trace exactly how each answer is created.

AI will continue to reshape how financial services firms compete, and the winners will be those able to balance innovation with governance. Verbatim exemplifies that balance, empowering firms to scale responsibly by harnessing AI where it accelerates value and locking it down where precision and trust are non-negotiable.

Verbatim, along with other features such as Content Health Dashboard, Fit Analysis Agent, and Executive Summary Agent, gives financial services teams AI that works within your regulatory reality.