Proposal teams in financial services (Finserv) are integral to a business's success. They translate complex, regulated offerings into clear responses that win trust and revenue. In a recent conversation with Matt Schiffman, former CMO of Legg Mason, we explored why AI in financial services is more collaborative than directive.

The takeaway is simple: teams that treat AI as a mindset, rather than a mandate from the top, and pair that mindset with strong knowledge discipline, pull ahead of the competition.

The real AI mandate is a cultural shift, not a technical one

Asset management firms that are leading the way in AI adoption first set a direction, then create an environment that allows teams to learn together. The idea is to encourage teams to experiment with AI to improve their productivity.

That kind of permission lowers the fear that often keeps practitioners quiet. In truth, there’s usually a gap between leadership perception and day-to-day adoption. Many employees experiment with AI on their own, both inside and outside the company, and then keep their findings to themselves. But at firms that “mandate the education” and make sharing safe, teams start to see real gains.

This aligns with the 2025 State of Strategic Response Management Report. High-growth organizations are three times more likely to embed AI across revenue functions and six times more likely to have fully deployed AI agents. This expansive use and integration of AI signals that leadership intent has successfully matched with enablement.

Proposal teams are storytellers, not utilities

When proposal work is framed as cut-and-paste, value gets lost. Treating the RFP team as a utility removes the team's ability to tell a story, a core differentiator between one asset manager and another. Instead, these teams should be viewed as essential to the storytelling process.

Financial services leaders are increasingly aligned with that view. Data in The Guide to AI in Asset Management illustrates that 77% of respondents said proposal teams are direct, significant contributors to revenue. Meanwhile, 76% view them as strategic business partners.

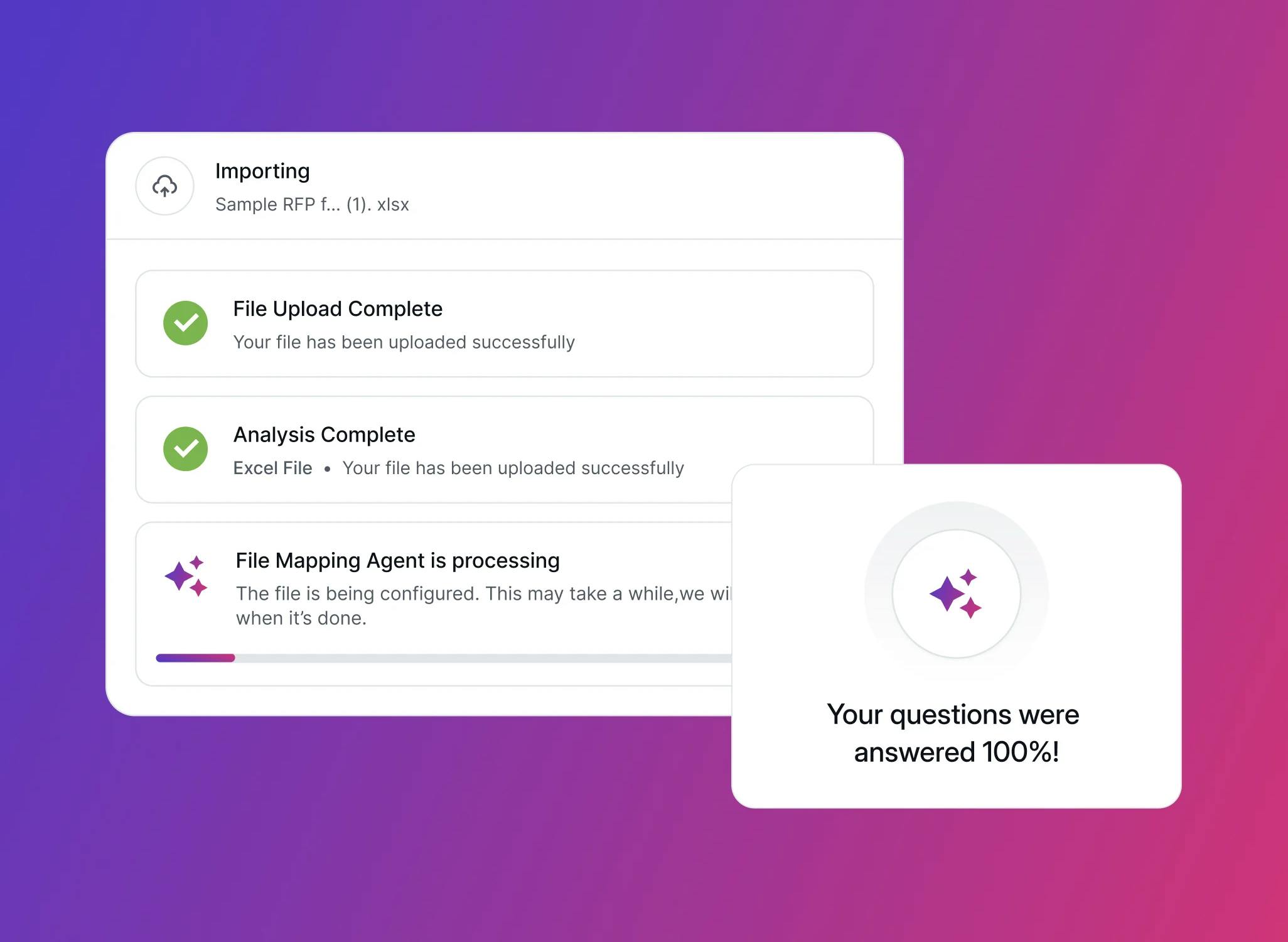

The shift from utility to storyteller changes how teams use AI. The most successful firms are not replacing the entire process with AI. Instead, financial services proposal teams are applying AI throughout the process to guide their storytelling efforts. It’s not just about speeding up the process, but about using AI agents to orchestrate workflows, surface insights from win-or-loss data, and inform go/no-go decisions.

AI mindset beats mandate as two forces drive adoption

In the Responsive Podcast episode, Matt brings up “AI mindsets” and “AI mandates.” What’s the real difference between the two? An AI mindset is a leadership stance and a team habit that establishes clear guardrails while treating AI adoption as a shared learning loop, encouraging people to experiment with AI and compare notes on what’s working, what isn’t, and why.

In contrast, an AI mandate typically comes from leadership and often reads as “everyone must use AI.” It’s a requirement that usually drives the wrong outcomes (fear, quiet resistance, and unsanctioned workarounds), especially in highly regulated and fiscally conservative environments such as financial services, where accountability is non-negotiable.

The better play is to mandate education and knowledge-sharing (so teams understand the tools, the risks, and the rules), while creating a safe space to experiment within those boundaries. That combination builds confidence and responsible use, which makes AI a clear difference-maker rather than a forced initiative that adds friction for both teams and the firm.

There are two key forces involved in the AI adoption process for financial service firms. One acts to slow down AI adoption, while the other serves as a compelling reason to get started sooner rather than later.

The first force slowing adoption across many firms is fiduciary responsibility, which requires careful change. The industry is understandably cautious, as firms can handle millions or even billions of dollars. Yet the benefits and use cases of AI have proven too significant to ignore, as firms continue to adopt it year after year.

Economic pressure is the other force. Margins compress, volumes rise, and silos creep in as firms scale. Scattered work across multiple computers and drives, as well as disconnected teams, will only exacerbate the problem.

Fortunately, there’s a simple solution: represent the firm with a single story across RFPs, DDQs, and sales interactions so everyone is on the same page and your storytelling draws on trusted, verified knowledge from a centralized library.

“Right now, firms are starting with low-risk applications like compliance checks, data analysis, and operational efficiency. But the real value will emerge in how we communicate with clients. That’s where I think AI can fundamentally change the game. When you’re responding to an RFP or following up on a DDQ, you need to deliver the right information — and make sure the message lands.”

Matt Schiffman

Co-founder at Totumai

As the majority of the 350 people surveyed in the Inside the Buyer’s Mind survey said, centralizing knowledge and aligning roles are no longer nice-to-haves. It’s become so important that it’s now an operational requirement.

A play many asset managers can run

Global asset managers face heavy volume, strict compliance, and rising expectations from consultants and allocators. The practical approach is to establish a single, governed knowledge base as the source of truth, then layer AI to retrieve answers, draft first-pass content, and maintain the library's cleanliness as products and policies evolve.

We see this pattern consistently. Proposal leaders centralize institutional knowledge, assign clear ownership, and give field teams self-service access. The payoff is evident in faster responses, reduced rework, and stronger consistency throughout the journey.

Microsoft, scale, and the power of a visible knowledge base

While an AI mindset is clearly beneficial for financial services firms, the mindset and benefits are not exclusive to that industry. Microsoft’s Proposal Center of Excellence (PCoE) shows what an AI mindset looks like at an enterprise scale.

The PCoE team built a proposal resource library in Responsive with more than 20,000 resources, created dedicated roles for knowledge managers, and made access company-wide through SSO. Sellers and proposal builders can now use AI to search for what they need faster, saving an average of 30 minutes per question and allowing them to focus on strategic work.

Microsoft paired that foundation with behavior change. A “Copilot challenge” encouraged people to try AI on real-world use cases and then share what worked. An AI champions network tests new capabilities and spreads learning across teams. For Microsoft’s PCoE, the North Star is impact, not activity.

The results speak volumes. Microsoft reports saving $17 million while supporting over 18,000 sellers, demonstrating that disciplined knowledge and intentional AI adoption can scale without compromising quality.

What FinServ teams should look for in AI

Trust is the gating factor for many financial services teams when it comes to AI adoption. 56% of organizations view data protection and privacy as the top criterion for AI agents. Teams want confidence that knowledge stays secure, compliant, and governed.

The Responsive 2025 Financial Services Industry Report found that although asset managers approach AI cautiously, they are already testing it aggressively. The pressure to operationalize AI across the response lifecycle is growing fast due to increased client and investor information requests. SRM platforms like Responsive have helped firms deal with this surge in demand. Over the past decade, we have seen how targeted AI applications can help financial service firms shift from reactive work to strategic execution.

Specifically, we’ve seen practical use cases with clear steps you can implement right away:

- Document shredding: AI-powered document shredding accelerates the early-stage qualification process by extracting critical asks, surfacing risks, and enabling faster, more informed go/no-go decisions.

- Go/no-go decision support: AI-powered analysis of past outcomes and competitive dynamics enables faster, evidence-based go/no-go decisions that protect team capacity and increase win rates.

- Surface insights from win/loss data: AI-driven win/loss analysis makes it easier to uncover what’s working, what’s not, and where to focus future efforts.

You can check out Responsive’s Guide to AI in Asset Management for the complete list of use cases and how your team can get started today.

Change grows when people see it working firsthand. Regardless of size and industry, it’s best to start small with AI adoption, present data, and involve allies in the story. You want to give people time and space to test AI, invest in basic prompt education, and ensure that your team remains in the loop, especially during the review process. Sticking to this slow, careful adoption process will turn AI from a query tool into a problem-solving tool.

Efficiency that funds better storytelling

Proposal volume and complexity are on the rise, and the work is taxing. The management challenge before proposal teams is clear, with focus on two key aspects: consistently telling the firm’s best story and improving efficiency so teams can handle the volume. Teams that do both will see an increase in pursuit capacity without burning people out.

According to the 2025 State of SRM Report, 62% of organizations are piloting or have fully implemented AI for revenue-generating activities, and another 28% are considering adoption. Teams that move beyond experiments and link efficiency to their pursuit strategy will find the revenue impact more quickly.

Practical next steps for financial services teams

Five key steps to effective AI adoption for proposal, client, and investor relations teams include:

- Stand up the source of truth. Centralize institutional knowledge with clear owners, then invite field teams to self-serve. Treat content governance like a product. Make it easy to find, easy to trust, and easy to keep current.

- Make AI usage visible. Create low-friction forums where people share prompts, wins, and misses. Try a lightweight challenge or champion network, similar to Microsoft’s approach, and collect the techniques that work so they spread.

- Start with the time-gainers. Deploy AI where the payoff is immediate, such as answer retrieval, first drafts, document shredding, and content cleanup. Measure time saved and quality maintained. Use those early wins to fund the next step.

- Move from speed to strategy. Instrument your process to bring go/no-go history, win/loss trends, and workload into decisions. Use AI to orchestrate work across SMEs, not just to draft individual answers.

- Anchor on security and governance. Select tools that respect data boundaries, log actions, and support the audit trail your risk and compliance teams expect. Treat security as a design requirement, not an afterthought.

What it takes for AI to find wins in financial services

Financial services AI leaders are not waiting for a perfect implementation playbook. They are bringing proposal, product, marketing, sales, and compliance into the same room to build the story, then using AI to carry that story across the journey. You want wins and losses attributed to the firm, not a single department, with leadership encouraging experimentation and education so that good ideas surface and spread.

Interested in learning more about the cross-section of managing volume and complexity with AI? Check out the Responsive Podcast episode with Matt Schiffman (former Senior Managing Director and Global CMO of Legg Mason), in which he discusses how AI and humans can collaborate to deliver authentic, compliant responses in asset management.

If you are shaping that journey at your firm, start with an AI mindset. Build the foundation, then let the tools help your people do what they do best: tell a clear story, move faster with confidence, and win the business that fits.