At 4:58 pm, a due diligence questionnaire lands. The client wants more detail, faster than last time, tailored to their mandate, and with added scrutiny from legal and risk. Your team has the muscle memory – you’ve shipped hundreds of proposals – but the game has changed.

Buying cycles keep stretching even as expectations for speed, accuracy, and personalization climb. That tension sits at the heart of this year’s Financial Services Industry Report from Responsive’s 2025 State of Strategic Response Management study — and it’s reshaping how firms plan, staff, and use AI across the pursuit cycle.

If you lead proposals, sales operations, or revenue strategy in banking, asset management, or insurance, this article will equip you with the industry’s top trends and practical ways to respond now.

For deeper benchmarks and the complete blueprint, get the report here: 2025Financial Services RFP & Proposal Trends Report.

Download the full report

The new pace of pursuit

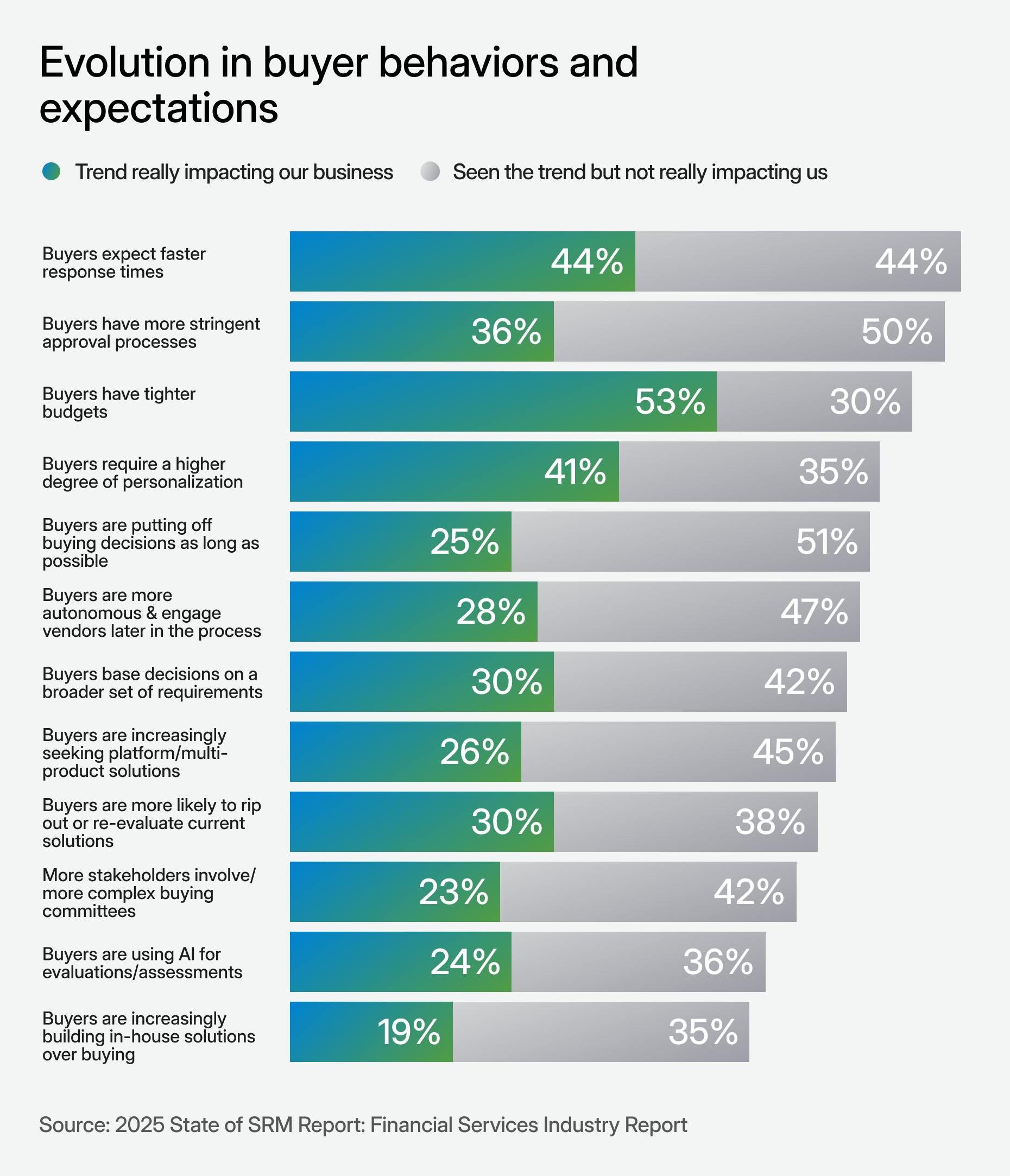

Clients are raising the bar across every stage of the pursuit process. The report shows a sector caught in a squeeze: nearly nine in 10 firms say client expectations for speed are rising, while three in four simultaneously face lengthening decision cycles.

That push-pull is forcing proposal teams to work harder to balance immediacy with patience, speed with accuracy, and personalization with scale. It’s a climate where every response carries more weight, and the margin for error is shrinking fast.

- Speed expectations: Nearly 90% of firms say clients now expect faster response times. For nearly half, this is significantly straining operations.

- Budget pressure: 83% of firms report buyers operating with tighter budgets, and over half (53%) say this directly affects their ability to win or retain business.

- Personalization: Three in four firms report higher demand for tailored responses.

- Extended decision cycles: 76% of firms say client decisions are dragging out, with a quarter noting it’s actively harming performance.

- Rising scrutiny: More than 85% have seen approval processes grow more stringent, making accuracy and compliance non-negotiable.

These influences have created new layers of pressure: tighter reviews, slower decisions, and sharper demands for personalization (all hitting at the same time).

From response to revenue

Proposal teams are no longer behind the curtain. Data from the report reveal that these teams are stepping into the spotlight, with leaders taking notice.

- 77% of financial services firms say proposal teams are direct, significant contributors to revenue.

- 76% view them as strategic business partners, not just support functions

- 79% say proposal teams are well resourced, and 83% report high employee satisfaction

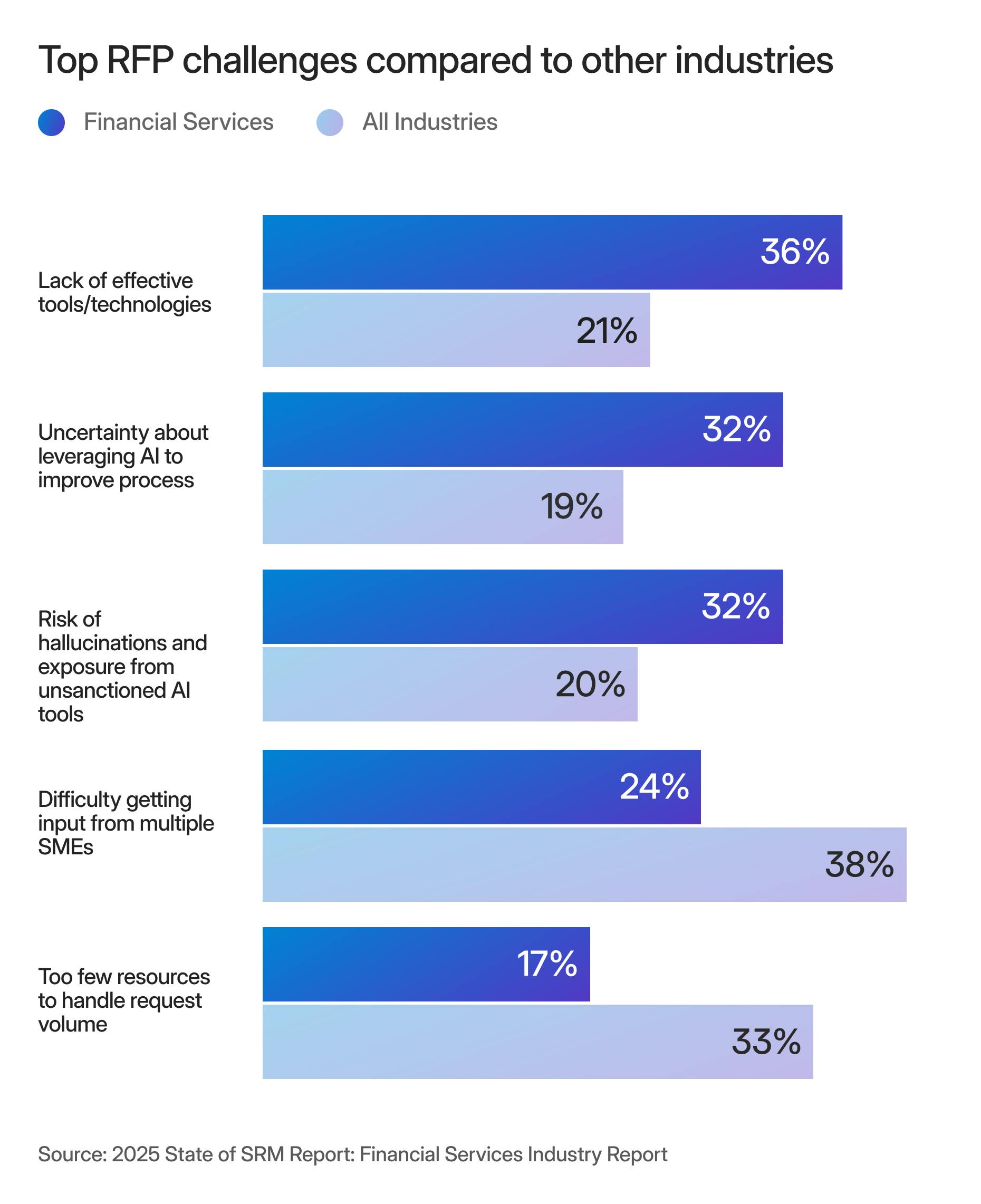

Yet the recognition comes with new pressure: 63% of leaders acknowledge that proposal teams face mounting demands. Tight deadlines remain the number one challenge (43%), and 36% of firms cite a lack of effective tools, which, concerningly, is far above the cross-industry average of 21%.

This gap between strong fundamentals and lagging tooling creates both a challenge and an opportunity. Teams excel at collaboration and driving business, but need modern technology to scale without burning out.

All in on AI (with financial-grade caution)

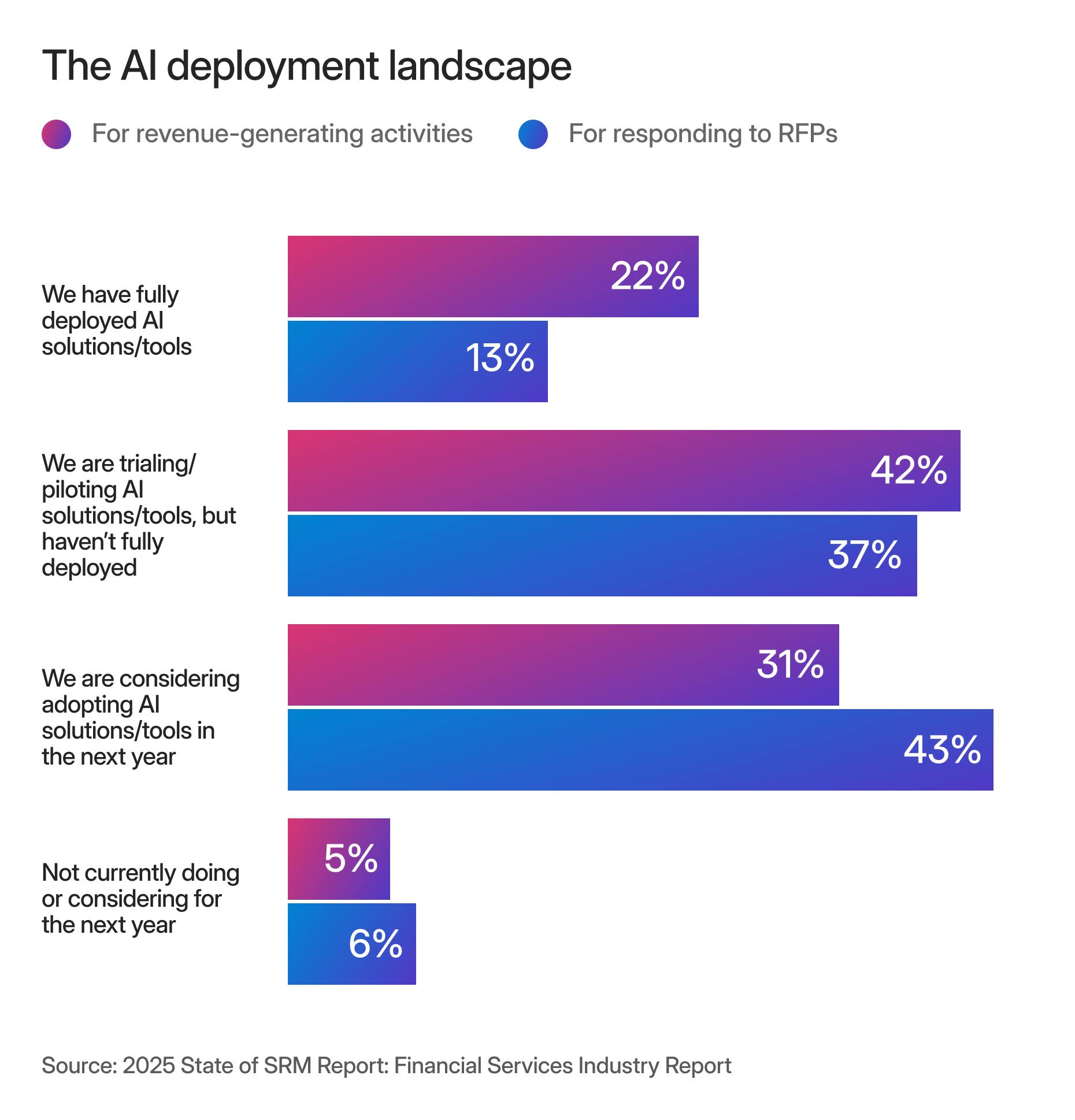

Firms are being pragmatic about AI adoption. Only 13% have fully deployed AI for RFP responses, though 37% are piloting and 31% are seriously considering it.

When firms do adopt AI, they overwhelmingly prefer purpose-built tools. In fact, 84% of financial services firms using AI rely on Strategic Response Management-specific platforms, compared to just 70% cross-industry. That preference reflects the sector’s sensitivity to compliance, security, and data integrity.

Where AI is gaining traction

- Content generation & refinement: to accelerate personalization without sacrificing quality

- Knowledge management & governance: centralizing content, flagging outdated material, ensuring compliance

- Document intelligence: analyzing RFPs, DDQs, and proposals to extract structured insights

- Workflow orchestration: routing assignments, tracking progress, and automating reminders

And the payoff is quick. Among firms that have fully deployed AI, most report positive ROI within the first year.

What leaders should do next

If you’re navigating extended buying cycles and escalating client demands, the report points to three immediate moves:

- Harden the foundation for personalization: Fewer than 40% of firms fully agree they have a centralized knowledge hub or clear self-service boundaries. Tighten these basics to reduce duplication, enforce compliance, and free proposal teams for higher-value work.

- Balance AI with human oversight: Start with low-risk, high-reward use cases like compliance checks, content clean-up, and draft response generation. Then expand into orchestrations and personalization, where AI accelerates the work and humans refine the story.

- Resource proposal teams like revenue drivers: Investment is already trending up — 73% of firms increased spend on proposal technology last year, and 54% boosted staffing. Tie that investment to clear metrics like time saved, win rates, and revenue influenced.

Quick trend recap

- Speed vs. scrutiny: 90% of firms face faster client expectations, but 76% say decision cycles are slowing.

- Proposal teams rise: 77% of firms see proposal teams as revenue drivers, but many still struggle with outdated tools.

- Infrastructure gaps: Fewer than 40% have fully adopted knowledge-sharing best practices, leaving much room for efficiency gains.

- Pragmatic AI adoption: Only 13% have fully deployed AI for RFPs, but most are piloting.

Where this is headed

The industry is strong on fundamentals but slower to innovate compared to peers. That gap is narrowing as firms invest in proposal technology, experiment with AI, and recognize proposal teams as strategic players.

The firms that will lead are the ones that build smarter systems, align teams around shared knowledge, and adopt AI deliberately.